August 21, 2024

What Age Do You Send Your Kid To Preschool Moms And Dads Organization Of New York City

At What Age Should You Make A Will? Also excluded are family members of EU people and family members of non-EU nationals who have right to relocate openly throughout the European Union. Please note, in this instance, your ETIAS take a trip authorisation is not legitimate for taking a trip to France. As a basic guideline, holders of diplomatic keys do not need an ETIAS, however some exceptions use and holders of specific type of polite passports may be required to have a visa. Because of this, it is recommended that you ought to obtain a brand-new ETIAS travel authorisation with an e-mail address that you can access to avoid any problems in your trip. Tourists with a valid visa do not require an ETIAS travel authorisation.Small (Regulation)

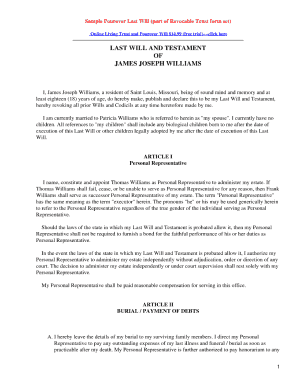

It's an extra formalized, enforceable method of designating obligations. With personal property, the law of the state where the decedent resides usually supersedes the laws of various other states. Simply remember to adhere to all the signing and observing requirements for the sort of will certainly you have actually created. In Ontario, only holographic wills (wills composed by hand) do not call for witnesses. If you're writing your will certainly with the assistance of any kind of mechanical procedure (will kits, printed records, typewriters and so on) you will certainly require 2 Helpful hints valid witnesses.- In most instances, the ability to contract is gotten to at the age of majority, which is 18 in a lot of countries.

- You might also incur additional expenses whenever you make an update to your will.

- When you ought to make a Will does not rely on your age, but instead, your monetary and individual conditions.

- You don't need to discuss your individual events, yet a person you rely on need to understand where to locate your papers in instance of an emergency.

- We recommend you not to travel with a document that will certainly end quickly.

Wills And Depends On

They often include managing monetary events, making medical care choices, and conducting legal purchases. Note that the power of attorney documentation might be for certain actions. Being near relative may designate an extra wide, much less specified set of obligations. Near relative condition is pointless unless the decedent was married and stayed in a community building state. If so, by legislation, the enduring partner is qualified to an equal section of any type of funds made or accumulated throughout the marital relationship, unless the partner had authorized a waiver.What Should I Do If I Slipped Up On My Etias Application?

Absent these classifications, a court might rule that your children cope with a member of the family you would not have picked. And in severe instances, the court might mandate that your children become wards of the state. A letter of intent is merely a record left to your administrator or a beneficiary. The objective is to define what you wish to be performed with a certain asset after your fatality or incapacitation. In order to qualify for this alleviation, you should submit Kind 5329 and affix a letter of description. If an account proprietor falls short to take out the sum total of the RMD by the due day, the amount not taken out undergoes a 50% excise tax obligation. PROTECT 2.0 Act goes down the excise tax obligation rate to 25%; potentially 10% if the RMD is prompt fixed within two years. The account proprietor need to submit Form 5329, Extra Taxes on Certified Plans (Including Individual Retirement Accounts) and Other Tax-Favored Accounts, with their government tax obligation return for the year in which the sum total of the RMD was required, but not taken. The RMD rules do not put on Roth IRAs while the proprietor lives.Here's the Net Worth of Married Couples by Age: How Do You Stack Up? - Yahoo Finance

Here's the Net Worth of Married Couples by Age: How Do You Stack Up?.

Posted: Thu, 27 Jun 2024 20:00:56 GMT [source]

How commonly do people transform their wills?

Social Links