August 16, 2024

Discretionary Counts On Vs Unit Counts On

The Role Of Discretionary Rely On Your Will Discretionary counts on do not gain from alleviation on stamp responsibility, even if the depend on is a 'first time customer'. Instead, an optional depend on will normally be responsible at the greater price of stamp duty. It is very important to note that where a major house passes to a discretionary trust fund, the RNRB will certainly not apply. However, the RNRB can be recuperated if the home is appointed out to direct offspring within 2 years of the testator's day of fatality due to section 144 of the Inheritance Act 1984.Just How To Set Up A Discretionary Trust

An additional use of this sort of trust fund is that it can safeguard cash from a recipient that is presently experiencing or likely to go through a divorce as the funds are dealt with as belonging to the count on. Nonetheless, specialist guidance need to be taken if this is the intention as the count on would call for careful administration. Do you wish to ensure that your enduring spouse will have an income for the remainder of their life? Learn even more about exactly how to provide for your companion with earnings from the count on and avoid inheritance tax. The position with a task to take into consideration working out discernment in non-exhaustive discretionary trusts is much more challenging, as the task to exercise discretion can be pleased by making a decision to gather. These types of depends on are additionally typically utilized by those wanting to trickle feed cash to prone recipients to prevent them from shedding any type of advantages they are qualified to.Do You Pay Inheritance Tax On An Optional Count On?

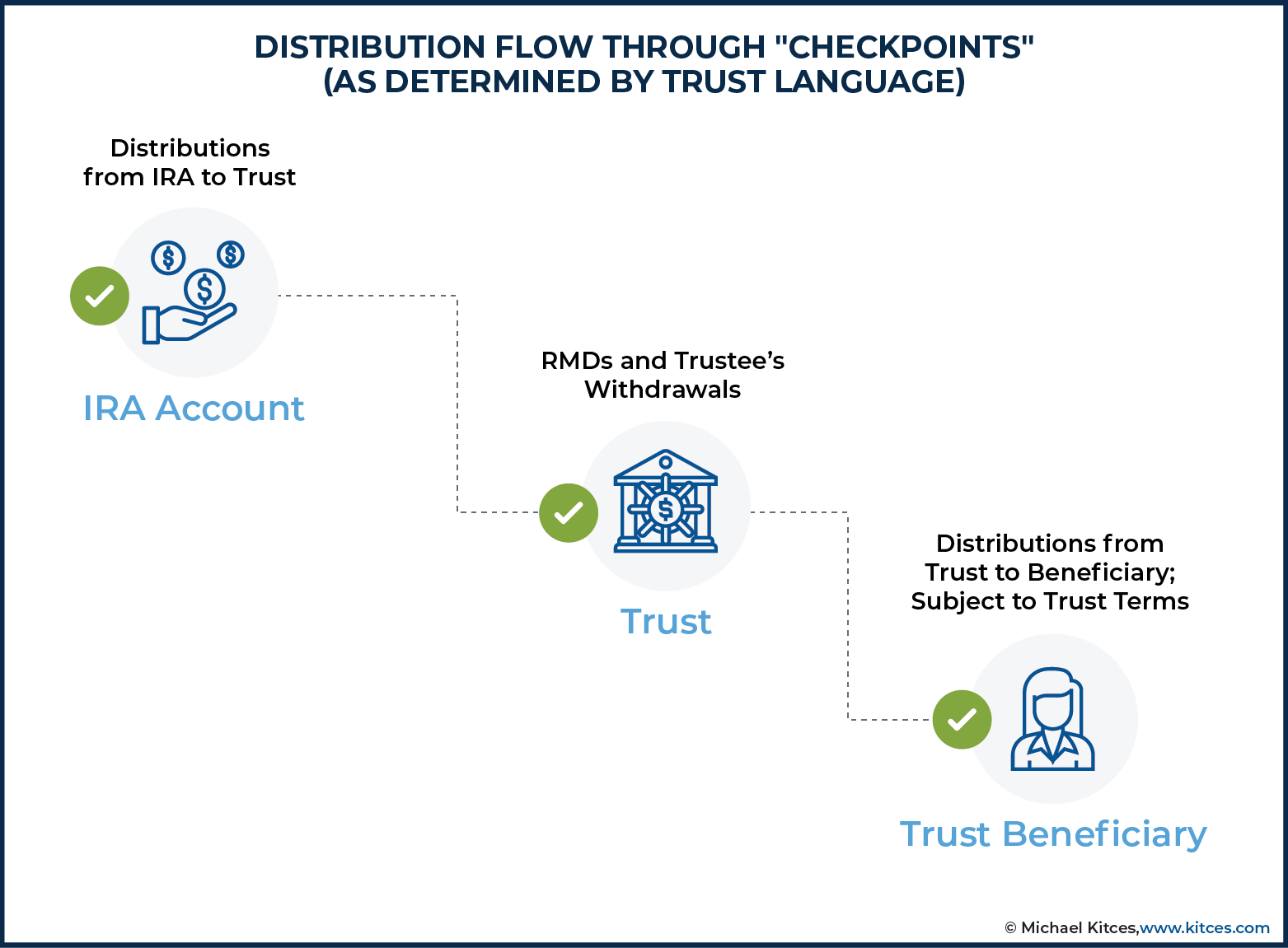

In thisparticular type of depend on, however, the trustee is given complete discretionaryauthority to make a decision when and what funds-- such as primary or earnings-- aregiven to which beneficiaries. Actually, the beneficiaries of a discretionarytrust have no legal rights to its funds and these funds are not considered part ofthe recipients' estates. The only means the funds end up being based on a creditoris once the funds are distributed to the recipient. So long as they remain in the count on and thetrustee is not required to disperse them to the beneficiary, they will certainly remainsafe.- The letter of dreams can be updated as typically as the settlor picks without the need to alter the trust.

- Manisha signed up with the Culture's Technical Recommendations Group in July 2019 having actually previously worked as a Work Solicitor in Warwickshire prior to transferring to Lincolnshire.

- A discretionary depend on is an adaptable vehicle for shielding possessions and maintaining control of just how and when they are dispersed while possibly sheltering them from the death rate of Estate tax.

- The price of tax obligation levied on funding gains relies on the possession held within count on, with residential property taxed at 28% and other assets such as stocks and shares, exhausted at 20%.

- We aim to provide fresh ideas, clear and straightforward explanations, and a service customized particularly to you.

Additional Technical Assistance

He leaves ₤ 500,000, web of any kind of estate tax (IHT) due, to a discretionary depend on with his son David, daughter-in-law Alison and her two children, Ben and Jessica, as potential recipients. These can be member of the family including spouses or civil companions, good friends, registered charities and also business. A beneficiary of an optional trust can include both people and charities. It is fairly usual for someone to stipulate the beneficiaries as their offspring which will consist of anybody birthed down their bloodline.TRS Update: New Guidance on Wills and Estates - Irwin Mitchell

TRS Update: New Guidance on Wills and Estates.

Posted: Sun, 14 Aug 2022 10:55:18 GMT [source]

Does an optional trust have a useful owner?

Bene & #xfb 01; cial ownership of the trust residential or commercial property lies with the bene & #xfb 01; ciaries. The trustee can also be any kind of skilled individual over the age of 18 (individual) who is not bankrupt or under some other legal handicap.

Social Links