August 12, 2024

Why Use A Discretionary Trust Fund?

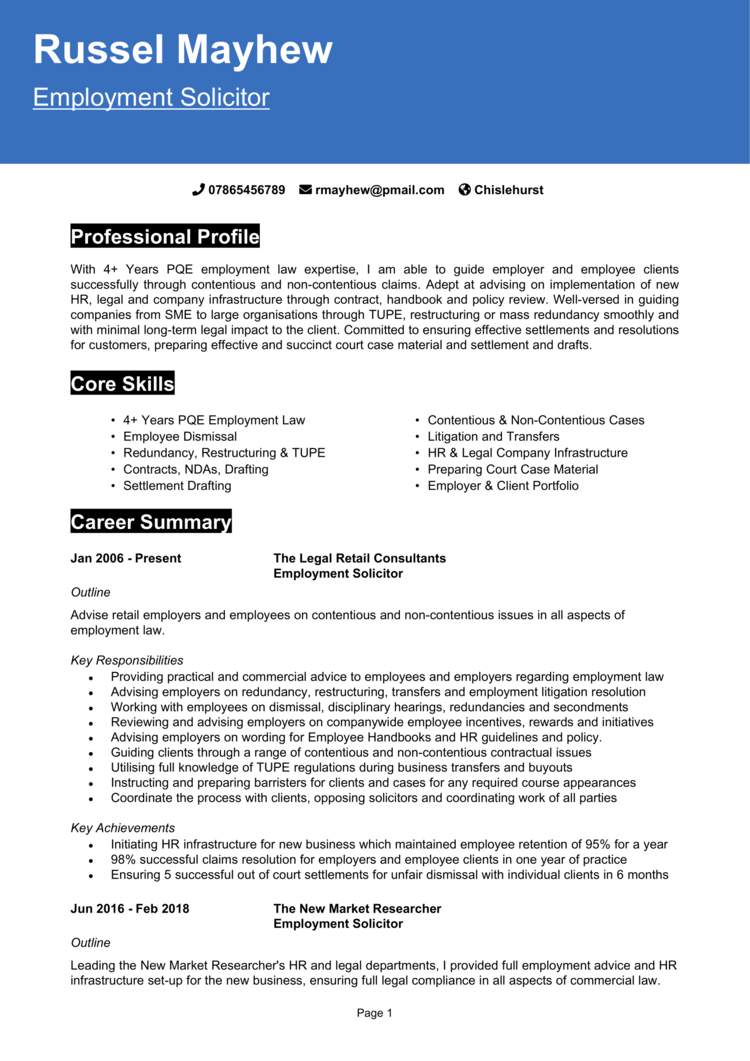

Optional Trust Wex Lii Legal Details Institute The court held that their optional powers proceeded, which they must exercise it in respect of the dormant years now as they ought to have done at the time. The court reaffirmed that if trustees decline to disperse income, or refuse to exercise their discernment, although the court might not oblige it be exercised in a particular fashion, it could purchase that the trustees be replaced. It is very important to note that letters of desires are not a legally binding document and as a result there is no commitment placed on the trustees to follow them. Becoming part of a trust can be difficult to navigate with the numerous legal and tax obligation demands. Nonetheless, it can be an extremely advantageous method to manage and shield your properties.Testamentary trusts are one of the last outrageous means of avoiding tax - The Conversation Indonesia

Testamentary trusts are one of the last outrageous means of avoiding tax.

Posted: Thu, 24 Sep 2020 07:00:00 GMT [source]

Use A Letter Of Dreams

In developing a discretionary trust fund, one have to take care to follow the federal and state law and guidelines that might relate to ensure the trust creates the preferred end result. For example, authorities vary on how much discretion must be provided to the trustee to be dealt with as an optional count on. Typically, even including the expression "shall" into the language on the discernment of the trustee will be dealt with as needing the trustee to make at the very least some circulations and for that reason be thought about as a different type of trust fund. A by-product of making use of a count on might likewise be an element of property security.Riches Protection With Assurance-- Call The Birk Law Firm

However, this is most likely to cause additional cost to the estate so we would certainly recommend the primary home is addressed independently in the Will. Last but not least, it can be made use of to safeguard cash from a beneficiary that is going through a separation. The benefit of entering their share of the estate in this depend on is that the trust fund funds will certainly not be treated as coming from the beneficiary as the count on has the properties and will consequently drop beyond the recipient's estate. As we have actually currently pointed out, the trustees of a Discretionary Count on are able to exercise their judgement. They can determine what and when a beneficiary gets, so it's crucial that the trustees are individuals you can rely on. Taking each factor above consequently, some beneficiaries might not be depended handle huge inheritances and the testator may be stressed that it will all be invested simultaneously. The advantage of making use of an optional trust here is that the trustees will certainly take care of the fund, providing cash to the recipient as and when they will need it and can basically drip feed funds. Allow us not forget the trustees do have complete discernment, so if a beneficiary with investing behaviors wants to buy a top of the variety sports car, the trustees are well within their remit to refuse this request. In such ascenario, a discretionary trust fund can be a good estate planning device. Below issome basic info on discretionary depends on and just how they might be beneficialto your certain household's requirements. For that reason, a joined up approach from your wide range manager, solicitor and accounting professional is frequently most reliable and sensible. Discretionary trust funds can be valuable for both recipients and possession protection, however it's important to evaluate up the tax ramifications and the more extensive trust fund management duties. The crucial issue is to seek expert recommendations and ensure that a discretionary trust is the very best lorry for supporting your loved ones as component of your long-lasting tax and estate preparation. In the ideal conditions, a Discretionary Depend on can offer control, protection and adaptability. In spite of the many advantages of setting up a Discretionary Count on, there are added intricacies, so our advice is to talk with a professional. SmartAsset Advisors, LLC (" SmartAsset"), a wholly owned subsidiary of Financial Understanding Innovation, is signed up with the U.S . If the trustee misuses Estate Planners their discernment or deviates considerably from your wishes your recipients may not obtain properties as you meant. It prevails for settlors to utilize a combination of these choices and to establish the preparation as they advance via life and situations modification. Certain counts on not just allow your customers to hand down riches when they die however can additionally provide accessibility to routine withdrawals when alive. Nonetheless, you should be aware that with counts on developed to accomplish a tax obligation conserving, your clients normally need to pass up access to at the very least several of the initial capital as well as any type of funding growth. All manner of possessions can be placed in a count on, consisting of financial investments and life guarantee policies.- There is no IHT cost on the gifts however they do eat up several of his NRB which lowers what can be utilized against the rest of his estate.

- Do not hesitate to discuss your options first with our group of solicitors and will writers in Leicester.

- The expression of dreams might stipulate, for instance, that the recipients should get only income and not funding, or that possessions ought to be dispersed on a recipient's 21st birthday.

- Assume no other gifts, related settlements or enhancements to the trust (and ignore exemptions).

- HMRC permits a reduction in the tax obligation payable by 40% and for that reason the quantity due is ₤ 18,000.

What are the negative aspects of a count on the UK?

Disadvantages of Putting a House Into a Trust

1. Price: the expense of establishing a trust can be pricey and can consist of lawful and administrative costs. 2. Loss of control: when you placed a residence right into a trust, you lose control of it and the trustees will certainly handle it on behalf of the recipients.

Social Links