August 8, 2024

Pour-over Wills In California The Law Practice Of Kavesh Minor & Otis, Inc

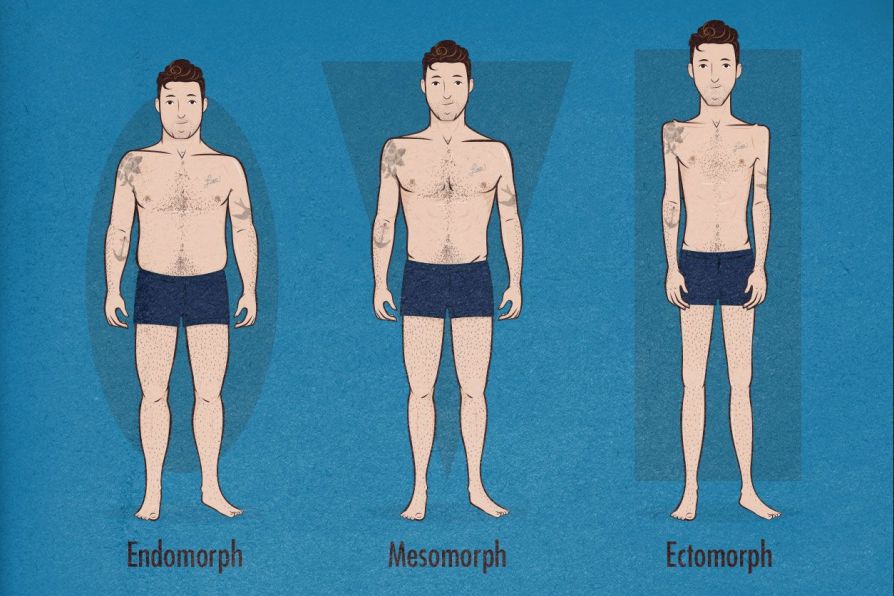

Pour-over Wills The more effort and time you take into preparing for your future, the more protection you'll have. You'll relax simple understanding that you have actually thought about, and gotten ready for, anything life tosses at you. Producing a Pour Over Will as part of your Estate Plan is in fact truly simple. Thinking about it as a safeguard can aid you recognize exactly how it works. Prior to you can create your Pour Over Will, you need to have a Living Count on established. When one member of the pair passes away, the joint pour-over trust fund can be liquified as it will no more have a feature.Stanley Paperless Pour Over Coffee Dripper - HYPEBEAST

Stanley Paperless Pour Over Coffee Dripper.

Posted: Tue, 25 Aug 2020 07:00:00 GMT [source]

Discover Lawyer

Though assets caught by the pour-over will certainly do not prevent probate, they eventually end up in the hands of your depend on. For instance, you might have properties that would be bothersome or impractical to move into the count on. Or you may acquire possessions after you create the trust fund and die prior to you have a possibility to move them or might simply fail to remember to alter the title of some properties. A pour-over will addresses any products that have actually fallen through the cracks or that have actually been deliberately left out. When you have actually moneyed the Count on (by transferring properties into it), you'll name recipients and information just how you want the Trust took care of when the Trustee action in. The Pour Over Will can suggest the end result is simple, total and personal (in that the Trust fund will certainly be the final holding place for all home and assets).What Are The Major Downsides Of Revocable And Irreversible Trusts?

Individuals commonly utilize pour-over wills and revocable depends on together to form an extensive estate plan.Creating a count on can aid your assets prevent probate once you pass. When properties are within a trust fund, they can be managed suitably for the decedent's heirs. Pour-over wills follow the exact same regulations as any various other wills in Texas and have to experience the Texas probate process.- Please call us if you wish to discuss the contents of this web site in a lot more information.

- Due to the fact that she only gets quarterly statements from that account and isn't actively collaborating with it, the pension plan totally slid her mind when establishing her living trust fund.

- The difference in between a simple will and a pour-over will is that a simple will certainly is indicated to handle your entire estate, such as by leaving it to your partner or your children.

- So, what is the link in between a pour-over will and revocable trust?

Does A Pour-over Will Have To Be Probated?

A Pour Over Will can be a conserving grace if you forgot to (or are unable to, or select not to) move assets into your Trust fund while you're still active. A pour-over will certainly gives a safety net, so any type of properties you fail to remember to transfer to your trust fund will at some point make it in. If you are confident that you do not have any kind of properties you desire to Holographic Will (handwritten) be in your count on that are not currently had by it, you might not require one. Nevertheless, a pour-over will certainly can inexpensively and properly provide you satisfaction if you are uncertain. We will certainly help you recognize whether you need to make use of a pour-over will or various other legal gadget to capture your estate planning requirements best. Making use of a pour-over will, in conjunction with a trust, handles this disadvantage. If the decedent does not have a will, after that the property will certainly pass beyond the count on by the legislation of intestate sequence. A put over will certainly in Florida assists to make sure that the objectives of the will and the trust stay in sync. This sort of modification does not create a problem unless a put over will is not used. Producing a living count on is amongst one of the most prominent ways whereby California locals avoid dragged out probate proceedings. Whenever a property is moved right into a count on's control, that asset is protected from probate. Nonetheless, any assets that are not turned over to the depend on prior to the creator's fatality might still need to be evaluated and approved by a court before they can be disbursed to recipients. Referring to the trustee by name, and not as your trust fund's official trustee, might cause your accounts and home passing to them as a specific as opposed to to the depend on. It can be testing to ensure every among your properties is put in your living trust fund. You might forget to relocate some assets or you might simply lack time and die prior to you obtain a possibility to relocate them all. Possessions recorded by a pour-over will need to go through the common probate process. Once the probate procedure is finished, the assets are moved into your trust to be managed for and distributed to your successors. Pour-over wills additionally do not protect your possessions from creditors or litigation.What's the point of a pour over?

Social Links