August 27, 2024

Why Make Use Of A Discretionary Trust Fund?

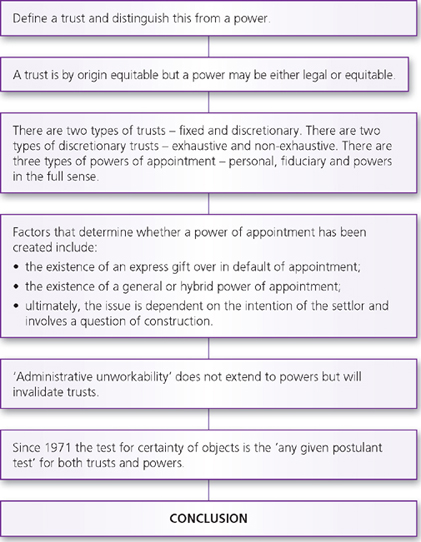

What Is A Discretionary Trust Fund? They should acquire and consider correct recommendations from an individual qualified to provide such guidance and has to likewise branch out the financial investments. The trustees can delegate their powers of financial investment to an expert asset manager. The function of the trustee( s) is to hold and carry out the depend on possessions for the use and advantage of the recipients. The duty does require a specific quantity of involvement and adherence to basic count on legislation and the details terms of the depend on.A lack of trust (1) - Law Society of Scotland

A lack of trust ( .

Posted: Tue, 21 Jan 2020 16:12:08 GMT [source]

Sorts Of Discretionary Trusts Available From Quilter

This framework avoids lenders from acquiring properties from the count on due to the fact that the recipients practically have no rights to circulations. Several trusts, wills, policies, and annuities have both main recipients and second recipients. A primary beneficiary is initially in line to obtain benefits upon the account or depend on owner's death. An owner can call several main beneficiaries and specify how distributions will be assigned along. An additional beneficiary inherits the assets if the main recipient passes away before the grantor. A second recipient would likewise be taken into consideration a "contingent recipient."Why Utilize A Discretionary Trust?

Some might not be depended care for a large inheritance and there may be a fear that the money will be spent simultaneously. This type of depend on enables trustees to take care of the trust fund to stop this from occurring whilst providing the economic assistance as and when it is required. For customers that possess their very own organization a discretionary trust fund can offer a helpful framework in which Great post to read to pass on shares in a household business, thus providing defense for the advantage of future generations. It is occasionally referred to as a family count on Australia or New Zealand. If you have actually not been registered for the SWW members Location, please contact us. Your personal information will just be made use of for the functions described in our personal privacy policy. With Discretionary Trusts, the Trustee can be a private, a business regulated by members of the family team or even an expert 3rd party Trustee firm. Much like Wills, Discretionary Depends on are a way of managing and distributing family wealth (you can likewise set up a Count on as component of your Will certainly - this is called a Testamentary Depend On). It is based on Quilter's interpretation of the relevant legislation and is right at the day shown. While we believe this interpretation to be correct, we can not assure it. For instance, they can issue food vouchers to the recipient which will guarantee it can just be spent on particular things. If the beneficiary resides in rental accommodation, for instance, they can set up to pay the property manager straight. Our group of experienced solicitors is constantly available to offer extensive support and specialist suggestions. The details contained in this update is for basic information functions only and is illegal recommendations, which will depend upon your particular conditions. Holding funds in the trust will certainly additionally safeguard the cash from the beneficiary's creditors or prospective personal bankruptcy. Where the discretionary trust fund is a testamentary trust fund, it is common for the settlor (or testator) to leave a letter of yearn for the trustees to guide them regarding the settlor's dreams in the workout of their discretion. An optional depend on can last for a maximum of 125 years; therefore, it is important to consider that the default recipients will certainly be i.e. those that will acquire the depend on fund when the depend on ends. Please see our earlier write-up laying out the common errors when drafting an optional trust fund. The depend on can end earlier in instances where every one of the recipients have passed away, or if the trustees have made a decision to relax the count on and distribute the trust fund possessions appropriately. What's unique about optional trust funds is that the beneficiaries are categorized only as potential recipients. They do not become actual recipients till the trustees make a decision to pass funds to them. Discretionary trust funds can also be made use of in other scenarios where you might have issues over exactly how depend on possessions will certainly be utilized. For example, you may choose to develop this sort of count on if you're bothered with your wedded kid obtaining separated and their spouse attempting to lay claim to their share of your estate. Or you might consider this sort of trust fund when you have minor children or unique needs dependents that are unable of making sound economic choices.- The Trustee has the discernment to decide when funds ought to be dispersed out of the Trust, to whom, and just how much.

- The trustee( s) may alter over the life of the depend on and it is feasible for new and/or substitute trustee( s) to be designated and for the trustee( s) to be removed or retired.

- It deserves putting in the time for more information about just how a Discretionary Count on works.

- Nonetheless, as she made an animal and died within 7 years of the family pet, it comes to be chargeable and you now look back from the date of the family pet and include any gifts right into optional count on made within 7 years of the PET.

How much does an optional depend on price UK?

also referred to as a living Trust.

Social Links