August 16, 2024

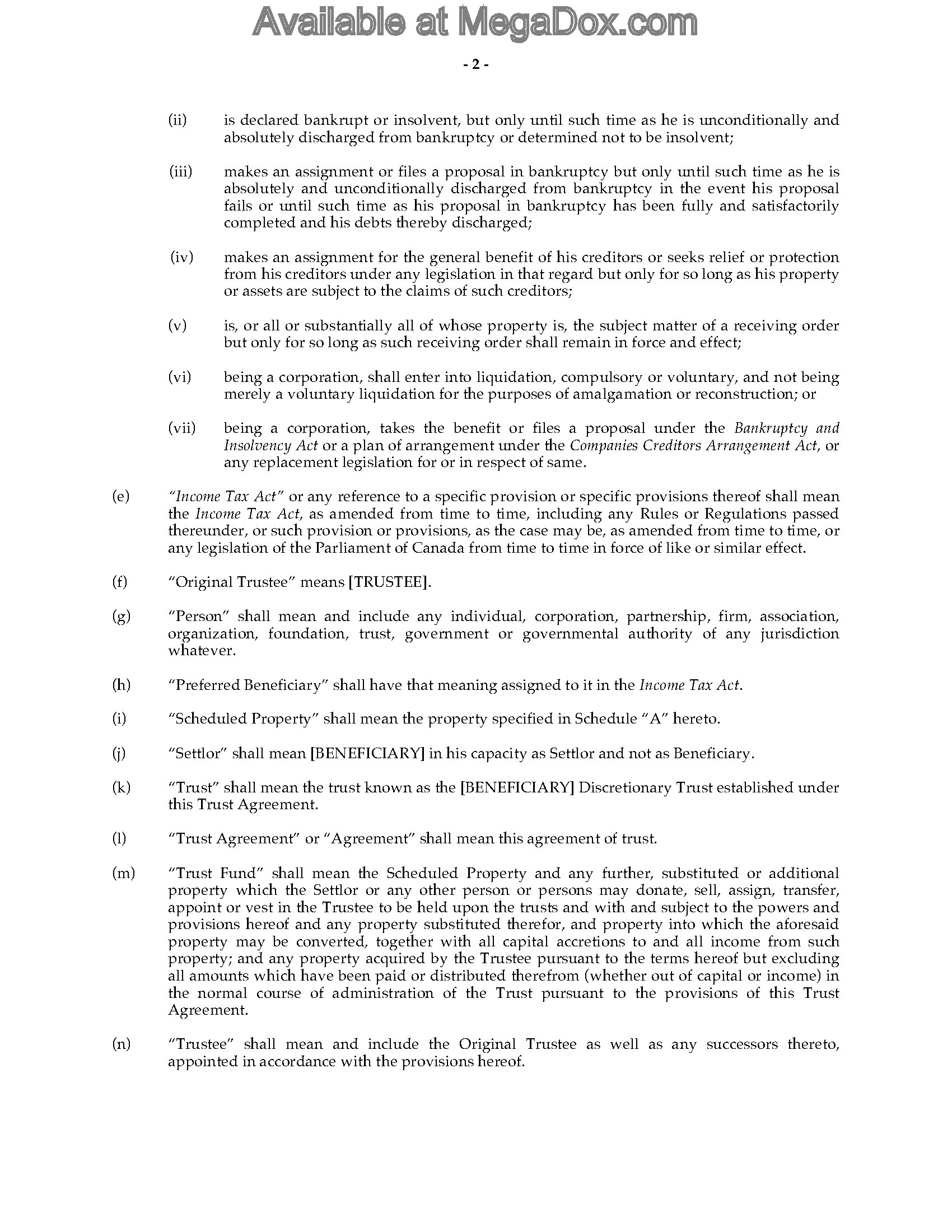

Discretionary Depend On Wex Lii Legal Info Institute

Discretionary Trust Wex Lii Lawful Information Institute For instance, setting up a Discretionary Count on prior to you pass away may mean you're responsible for estate tax (IHT) https://seoneodev.blob.core.windows.net/family-will-services/will-writing-consultation/family-trust-setup/what-are-the-demands-for-a-will-to-be-legitimate-in-br.html if you die within seven years. An optional depend on can make more feeling in specific economic scenarios than others and it's important to think about both the benefits and drawbacks. As pointed out, the chief advantage of this sort of count on is the capability to preserve possessions for beneficiaries under the assistance and discretion of a trustee. This assumes, nonetheless, that the person you pick as trustee will certainly act to protect your wishes as much as possible. As a discretionary car loan trust fund, there are no called beneficiaries, just a checklist of pre-determined people and various other legal entities that might come to be a beneficiary.- They need to acquire and take into consideration appropriate suggestions from an individual qualified to offer such guidance and must also branch out the investments.

- You currently have satisfaction recognizing that your child will certainly constantly have a safety net in the form of funds held in the Count on.

- Mattioli Woods is illegal or tax advisors and before establishing an optional count on it is necessary to listen from a professional solicitor around.

- Manisha offers suggestions on technical queries for Culture Members and continuous support on our specialist drafting software, Sure Will Writer.

- A more use this type of trust is that it can secure money from a recipient that is currently going through or likely to experience a divorce as the funds are dealt with as coming from the trust.

The Function Of Discretionary Rely On Your Will

The trustees can make a decision which of the recipients obtain a distribution, just how much they obtain and when they receive it. It is necessary that trustees are individuals you count on, as you basically hand all choices over to them. Discretionary trusts are a type of unalterable count on, meaning the transfer of assets is long-term. When a person creates an optional depend on they can call a trustee and one or more follower trustees to supervise it.Responsibilities Of Trustees

Wills and trusts: how to plan your finances for when you’re gone - The Guardian

Wills and trusts: how to plan your finances for when you’re gone.

Posted: Mon, 28 Feb 2022 08:00:00 GMT [source]

Exactly How Do You Set Up An Optional Count On?

A family members trust fund has a range of benefits for an individual's possessions on asset protection and tax reasons, along with peace of mind. The grantor can set standards on when trust fund properties must be dispersed and just how much each trust fund recipient must obtain. Yet once again, it's up to the trustee to decide what choices are made when it come to distributions of principal and interest from trust assets. While they might get circulations, it depends on the trustees to identify whether the repayment will certainly be made based on the discretionary direction. Helen dies between 4 & 5 years after making her present into discretionary depend on, the gift was ₤ 400,000 (presume tax obligation was paid from the depend on fund) and the NRB offered at the day of her death is ₤ 325,000. As the gift goes beyond the NRB, the tax obligation on the present is recalculated using the full death price. Generally the trustees can select from a broad course of beneficiaries (omitting the settlor) to whom they can distribute the trust fund funds. The beneficiaries do not have any privilege to the depend on fund therefore it does not develop part of their estate on divorce, bankruptcy or death. Due to this adaptability the counts on are potentially based on an access fee, a ten yearly fee and an exit fee. Occasionally optional trusts are referred to as "negotiations" or "pertinent building depends on". An optional count on is a kind of count on where the trustees are offered complete discretion to pay or use the earnings or resources of the assets for the advantage of one or every one of the recipients. In a normal depend on plan, possessions are managed according to the instructions and dreams of the trust fund designer or grantor. For example, you might define that your youngsters have to wait till they graduate college or transform 30 before they can access trust properties. In the United States, a discretionary recipient has no lawful proprietary interest in a trust fund. Discretionary count on the United Kingdom likewise allow versatility in the resolution of the distribution of properties to people. Allow us take the instance of a widower, Mr Brown, that has actually lately died.How does an optional trust shield possessions?

Social Links