August 12, 2024

Living Trust Fund And Pour-over Will: Working In Tandem Understanding On Estate Preparation

Texas Pour-over Wills Overview Massingill Some people use pour-over wills to ensure any type of valuable assets they forget to put into the trust remain secure. Similar to any will, your administrator has to handle particular bequests included in the will, along with the assets being transferred to the trust with the pour-over arrangement prior to the trustee takes over. (Exceptions may apply in certain states for pour-over wills.) While this might take months to finish, home transferred straight to a living count on can be dispersed within weeks of the testator's fatality.Estate Planning Blog

Unless your estate gets probate faster way, properties that go through the pour-over will certainly still need to experience probate. The specifics of which heirs obtain cash and property under intestacy laws will certainly rely on which living relationships you have. For instance, if you are married and have youngsters from outside that marital relationship, generally a part of the assets in your estate will certainly pass to your partner and a section to your children. The major advantage of an irreversible trust is that the possessions are eliminated from your taxable estate. However this might not be very important to you if the estate is totally secured from tax by the federal gift and inheritance tax exception.Wills Causing Spills: Caution - Pour-Over Clauses are Void in B.C. - Clark Wilson LLP

Wills Causing Spills: Caution - Pour-Over Clauses are Void in B.C..

Posted: Tue, 04 Jul 2023 07:00:00 GMT [source]

Benefits Of Pour-over Wills

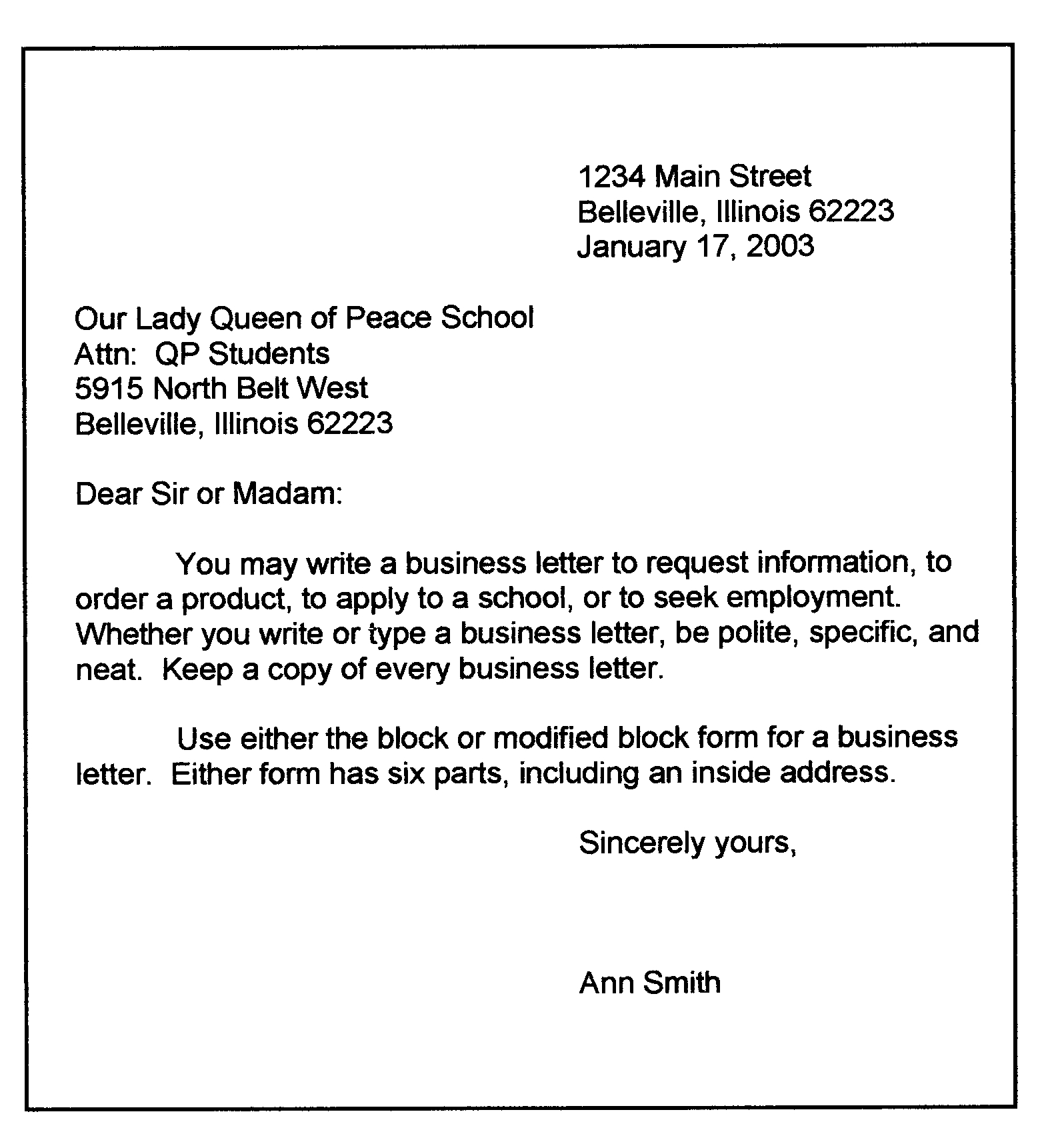

You've chosen to create different wills, however you both concurred that a trust fund is the very best way to pass assets to your family and friends. A pour-over will certainly likewise usually gives that if the depend on is partially or entirely void, properties should be dispersed under the regards to the void trust. If the pour-over provision stops working, the properties are distributed according to intestacy. It is important to get in touch with a knowledgeable attorney in the area of estate planning to effectively compose a pour-over will. The Uniform Testamentary Additions to Trust Act (UTATA) enforces a number of needs for this testamentary system to be honored by the probate court. The will should show the intent to integrate the trust, the trust fund has to identify the pour-over will, and the trust fund document have to be carried out before or contemporaneously with the will.- Both revocable and irreversible depends on can be pricey to prepare, complex to undo, when it comes to an irreversible trust fund, and pricey to revise, when it comes to a revocable trust fund.

- That, preferably, makes it much easier for the executor and trustee billed with finishing up the estate.

- If you do not have a last will and testimony, your non-trust possessions will certainly be dispersed according to the laws of intestate sequence in your state.

- Sending a call type, sending a sms message, making a phone call, or leaving a voicemail does not produce an attorney-client partnership.

What are the disadvantages of put plate technique?

- Extra time-consuming and labor-intensive compared to various other methods.Requires accurate temperature level control to prevent warm damages to microorganisms.Less efficient for refining a multitude

- of examples rapidly. It can be a laborious, time-consuming process, which is

Social Links