August 14, 2024

Estate Planning For Company Owner New York City State Lawyer

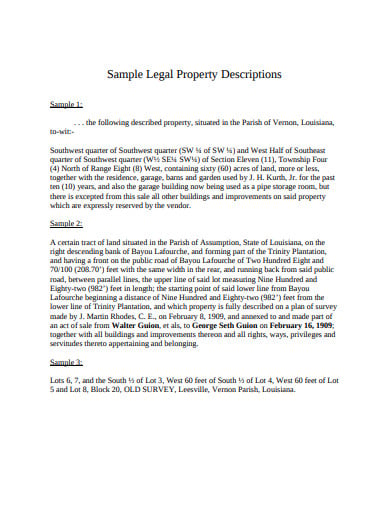

Just How To Make A Will Without An Attorney: Make Use Of An On-line Layout Very commonly the success of the business is tied straight to the partnerships and count on your liked one has actually constructed for many years with coworkers, team, vendors, and business networks. This is a more economical way to develop will and depend on files compared to going to a lawyer or in-person lawful service. Most online will certainly makers stroll customers through a series of concerns to inhabit the needed fields.Who Do I Need To Hire When Selling My Company?

This insurance is needed for certain careers such as accountants and economic experts. This secures them versus claims for losses experienced by clients as an outcome of errors or neglect. Frequently other expert experts determine to take this cover out for their own comfort in case their customers intend to sue them. Some individuals favor to handle sole investors over restricted firms as the business tends to feel extra individual, especially if the nature of the job is delicate. You're establishing a company plan, obtaining your financial strategy in order, and perhaps pitching to financiers or looking for financing. One thing that can be forgotten however is incredibly important, is making certain all legal commitments are satisfied.Tips To Share Value To Your Clients And Prospects

As your relied on lawful experts, you can count on our experience, experience, and dedication to assist you through the complex estate preparation factors to consider for local business owner in New york city State. We are committed to shielding your service, assets, and liked ones, and assisting you accomplish your long-term objectives. As a business owner in New york city State, you have actually worked tirelessly to build and expand your venture. Nonetheless, have you considered what will occur to your service and possessions after you're no longer around? Estate preparation is a vital step for local business owner to guarantee a smooth shift of their service and protect their enjoyed ones from unnecessary complications.Leading Qualifications For Local Business Owners In 5 Essential Skill Locations

This organization framework calls for marginal documentation and offers flexibility if you decide to freelance part-time. When the proprietor of an LLC passes away, some states declare that the LLC should liquify unless a certain strategy of sequence has been made. When a household LLC is developed according to the state's legal process, parents can begin transferring properties. They make a decision just how to convert the market worth of those possessions right into LLC units of worth, similar to stock in a corporation. Moms and dads can after that transfer possession of LLC devices to youngsters or grandchildren.- This service framework offers minimal responsibility, separating your personal and expert properties

- We stated this in the past, but if you utilize team besides direct member of the family then you require to take out employers responsibility insurance policy.

- For those who don't wish to read this whole short article, the short solution is indeed!

Social Links