August 30, 2024

Every Little Thing You Need To Learn About Shielding Your Business In A Separation

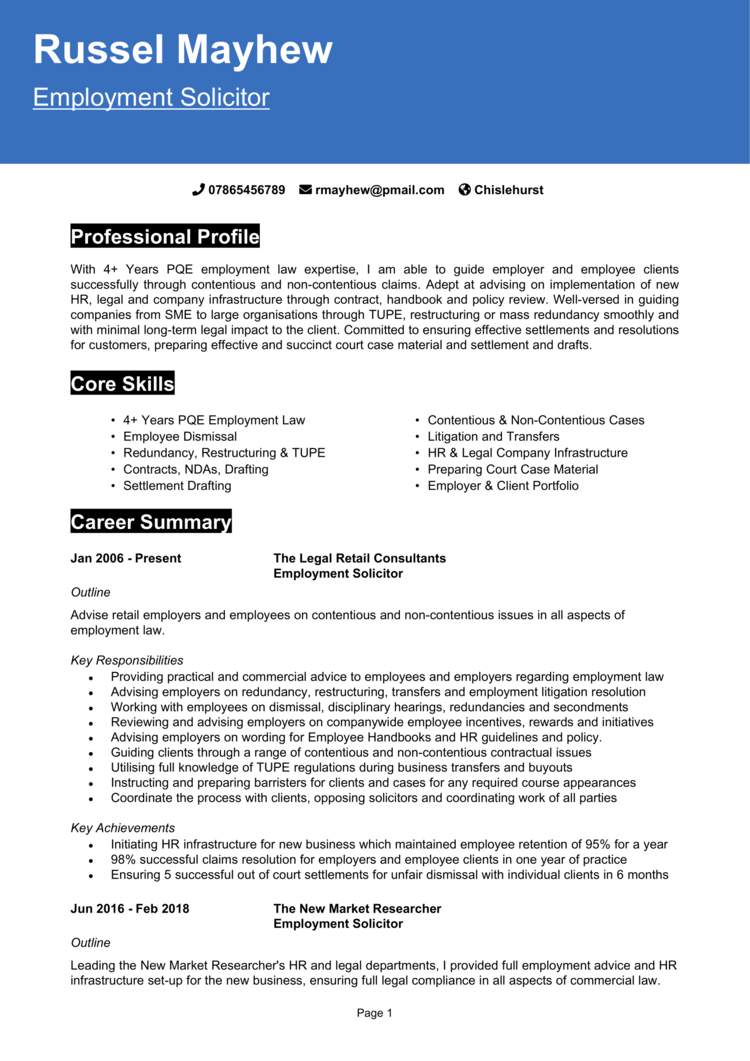

Estate Preparation Considerations For Local Business Proprietors Discuss your decision with them ahead of time and ensure they are willing to take on the obligations entailed. While creating an estate strategy is vital, it is equally vital to interact your objectives and the information of your strategy with your family members, company companions, and crucial staff members. Clear communication can aid protect against misconceptions, disputes, and conflicts among your loved ones and stakeholders. By discussing your estate strategy openly, you can offer clearness on your desires and alleviate any kind of prospective uncertainty or tension.Is Legalzoom A Great Way To Create A Living Depend On?

Business vs. Personal Credit Cards: 6 Differences - NerdWallet

Business vs. Personal Credit Cards: 6 Differences.

Posted: Fri, 24 May 2024 07:00:00 GMT [source]

- We will touch on the much more common ones, but to discover even more legislation please browse through

- See Nolo.com for more details and resources to create these papers by yourself, including books, articles, and online items.

- Our content team is dedicated to making sure the accuracy and currency of web content pertaining to estate preparation, online wills, probate, powers of lawyer, guardianship, and other related topics.

- Restricted responsibility firms (LLCs) are needed to have an operating arrangement that includes what occurs in case an LLC proprietor passes away.

Kinds Of Wills

"Freezing" an estate in favour of a family members count on is specifically helpful for a business owner to shift a household business or business entity and its future wealth to kids, various other relative or 3rd parties. The beneficiaries remain to cooperate the partnership's financial interests but can not participate in supervisory passions. If the collaboration's debts are more than its assets, the estate might wind up owing business money. If there is no official partnership arrangement, the death legally dissolves the collaboration, and all business activity stops except for the steps necessary to liquidate the partnership. Wills and trust funds are both vital estate-planning devices, yet they vary in essential methods.Organization Facility

From coming up with an organization idea to taking that concept to market, this guide supplies handy information every action of the means. We're honored to sustain every person and household, despite their age, race, religious beliefs, ethnicity, sex identification, or sexual orientation. If a coworker is regreting the death of a liked one, it can be challenging to know what to anticipate, what to claim, and just how to be of comfort. If a participant of your team is returning from grief, maintaining a few straightforward points in mind can help a great deal. To recommend the best, we have actually thought about convenience of usage, schedule in all states, and the capability to upgrade information easily. Joint wills aren't as usual as they when were because of this inflexibility. This is the simplest alternative if you are the only owner (you can still use individuals). There is no organization registration with Companies Residence needed and maintaining records and accounts is basic. Several organizations start off as sole traders and alter their legal status later on. Nonetheless, a crucial element of estate preparation includes paperwork in case you become incapacitated. Some insurance plan are legally needed, whereas others are readily available if you want to shield your company versus particular threats. Parts of the business that you can guarantee include your lorry, tools, properties, employees, your product or services, your business idea, and also yourself. The drawback is that like being a single trader, companions are not safeguarded financially. If the business goes under you can end up being responsible for your partner's share of the financial debt. To prevent this situation, you can end up being a Limited Obligation Partnership (LLP) to ensure that the LLP is after that responsible for any kind of financial obligation and not the business owners. A capitalization table, commonly referred to as a cap table, is a comprehensive spread sheet or journal that tracks the equity ownership of a firm. A failure to maintain track of and evaluate your monetary documents can leave you questioning how well your firm is doing. In addition, it makes it hard for a lender to assess your practicality and depend on your ability to repay the financial obligation without records. Then, planning when you will need cash and where to put it when you obtain it is critical. Earnings tax obligation is most likely not the only tax obligation you are responsible for paying into, so it's important to understand various other tax demands you might have.Social Links