Pour-over Wills In California The Law Practice Of Kavesh Minor & Otis, Inc

Living Count On And Pour-over Will: Working In Tandem Insight On Estate Preparation If the decedent does not have a will, then the residential property will certainly pass outside of the depend on by the legislation of intestate succession. A put over will certainly in Florida assists to make certain that the purposes of the will and the trust fund stay in sync. This kind of adjustment does not create an issue unless a pour over will is not utilized. Creating a living trust is amongst one of the most preferred means through which California residents stay clear of drawn-out probate procedures. Whenever a property is transferred right into a depend on's control, that possession is shielded from probate. Nevertheless, any type of possessions that are not turned over to the trust fund prior to the creator's fatality may still need to be evaluated and approved by a court prior to they can be disbursed to beneficiaries.Best pour over coffee maker for great coffee with minimum effort - T3

Best pour over coffee maker for great coffee with minimum effort.

Posted: Sat, 18 Jan 2020 13:55:23 GMT [source]

Added Residential Property

Consequently, the assets may be distributed in a manner the person would not have actually wanted. A pour-over will certainly is an invaluable file for any individual that has created a living trust as component of their estate strategy. It's a specialized last will and testament, made to capture properties that have actually not been retitled or transferred into your living trust fund, "putting" them right into the trust fund upon your fatality.Just How To Develop A Living Trust Fund With Put Over Will - Making Use Of A Pour-over Will In Estate Planning?

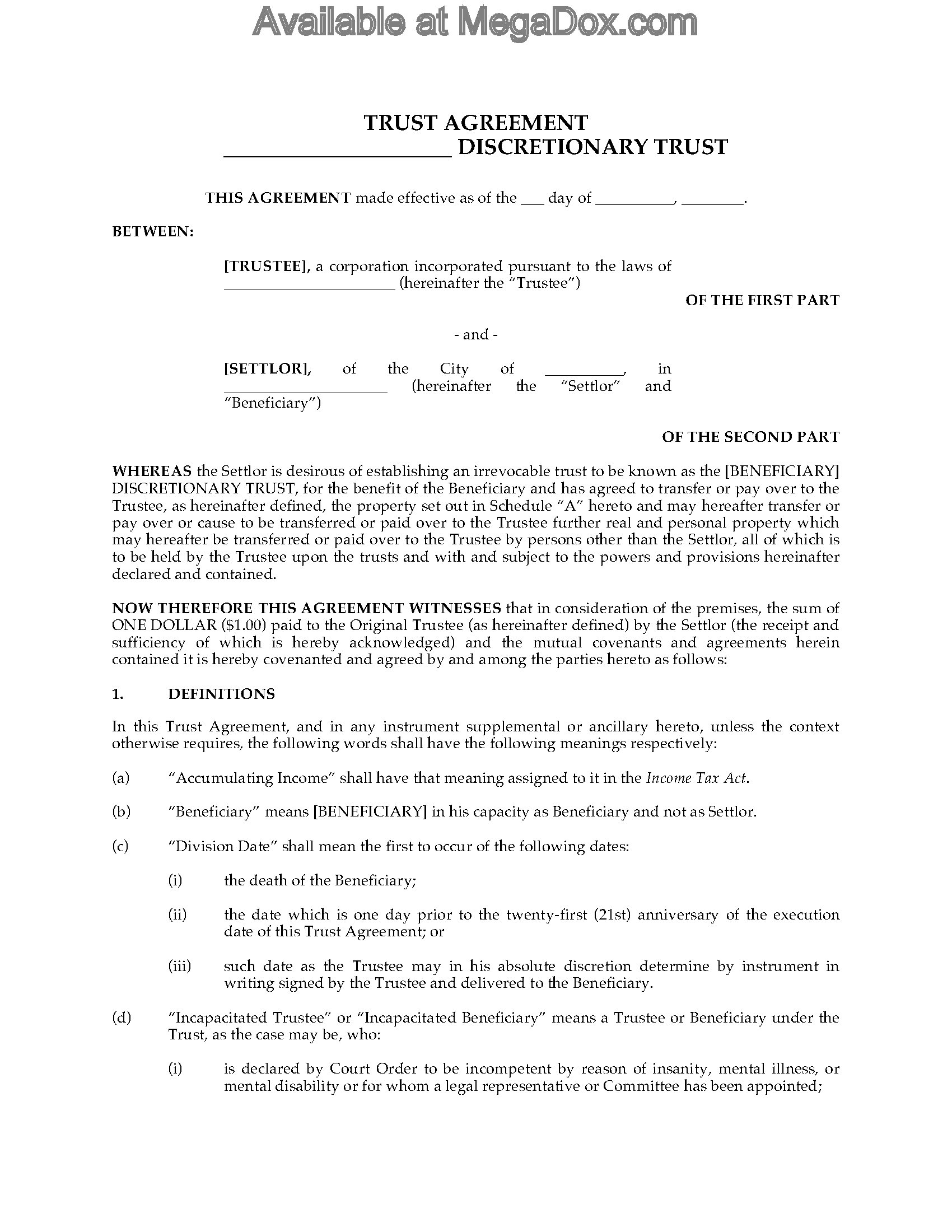

Sadly, any type of properties that are poured over must experience probate due to the fact that they will not have actually been currently possessed by your depend on prior to your fatality. Visit our extensive pour-over will direct for more details, and to find out if you would certainly gain from this kind of will. Now, let's state the exact same private creates an irreversible depend profit their household and shield their possessions. As opposed to naming themselves the trustee and recipient, the grantor would usually designate a different trustee and feel protected surrendering ownership and managing possessions, such as residential property. They will currently need to thoroughly vet a trustee and a trust guard that works as an oversight manager of the depend on- Nevertheless, remember that these possessions will certainly have to go through probate initially.

- States have intestacy legislations which define which family members must inherit.

- Nevertheless, an irreversible trust fund is a little bit much more complicated to establish than a revocable trust, specifically because it can not be altered.

- Together with the trust fund, they both draft pour-over wills guiding any type of continuing to be possessions be added to the count on upon their deaths.

- Upon your death, possessions held in the living trust can transfer utilizing the count on management procedure.

Does A Put Over Will Stay Clear Of Probate?

The even more time and effort you put into planning for your future, the a lot more protection you'll have. You'll rest easy recognizing that you have actually thought about, and planned for, anything life throws at you. Developing a Pour Over Will as component of your Estate Strategy is actually truly simple. Thinking about it as a safeguard can aid you understand how it works. Before you can develop your Pour Over Will, you need to have a Living Depend on developed. When one participant of the pair passes away, the joint pour-over depend on can be liquified as it will certainly no more have a feature. It also shields properties from lenders in suits, and assets are exempt to inheritance tax. If you're thinking about establishing one, seek advice from a certified count on lawyer. A pour over will offers many advantages for estate preparation with one of the advantages being that the put over will certainly assists to make use of the revocable or unalterable counts on that an individual develops. A Florida Living Trust fund is an additional great tool that allows an individual's building to bypass the probate procedure when he or she passes away. A Pour Over Will is just a type of Will you create that will certainly enable assets to immediately transfer to a formerly set-up Living Count on. It works for those smaller sized possessions that you might have forgotten, or for those you selected to not put into your Trust fund for any kind of number of factors. A Pour Over Will definition may be easier to understand if you can check out an example. UTATA specifically determines that any probate properties moved to a living depend on be dealt with identically to various other properties in the depend on, therefore saving the probate court considerable time and price. Some territories need that if the depend on document is changed, the pour-over will certainly need to also be republished, either by re-execution or codicil. In these territories, if the count on is revoked by the testator and the pour-over condition is neither modified neither removed, the pour-over present lapses. You can have both a will and a trust, and actually, an unique kind of will certainly-- known as a pour-over will certainly-- is frequently utilized along with a living trust fund. In Texas, pour-over wills are lawful records that help estate planners make sure that all a decedent's assets end up in their trust fund. Making sure a depend on has all properties is critical because it allows the executor to transfer them to your successors successfully. However, not all of your properties may be possessed by your depend on since you need to transfer title in order for the trust to take ownership. In assembling your estate plan, one alternative you might pursue is developing a revocable living depend on. During your life time, you can access the assets in this sort of Educational Content trust and additionally make updates to it as needed. A revocable living trust likewise assists your liked ones prevent the lengthy process of probate when you die. Must you go this course, you may consider setting up an associated record referred to as a pour-over will as well. A pour-over will certainly is a last will and testimony that acts as a safety tool to record any assets that are not transferred to or consisted of in a living trust fund. While "financing" a living count on can be an easy procedure, often assets don't constantly make it to the trust fund for a range of reasons.What is the best kind of depend have?

You can likewise make simply the correct amount of coffee to ensure that it's as fresh as feasible and you earn less waste.'M irrors can easily make your space really feel bigger & #x 2013; but at the same time & #x 2013; they often tend to show much power throughout the room. This will influence and diminish [the room's] power,' says expert Nishtha Sadana from Decorated Life. This can' impact your health and wellness by interrupting your sleep and cultivating sleeping disorders.'. However, grantors aren't always able to move all of their properties right into a count on time. That's where pour-over wills been available in. Think about a pour-over will as a failsafe. If any possessions are unaccounted 'for, a pour-over will certainly guarantees they're immediately placed in a count on for a grantor's called recipients. The huge difference is that a pour-over kit consists of a pitcher and a paper filter, not a mesh strainer like a French press has. To brew a mug of pour over, you merely put the filter in the top of the carafe, pour in your ground and afterwards pour hot water over this.