August 30, 2024

Texas Pour-over Wills Overview Massingill

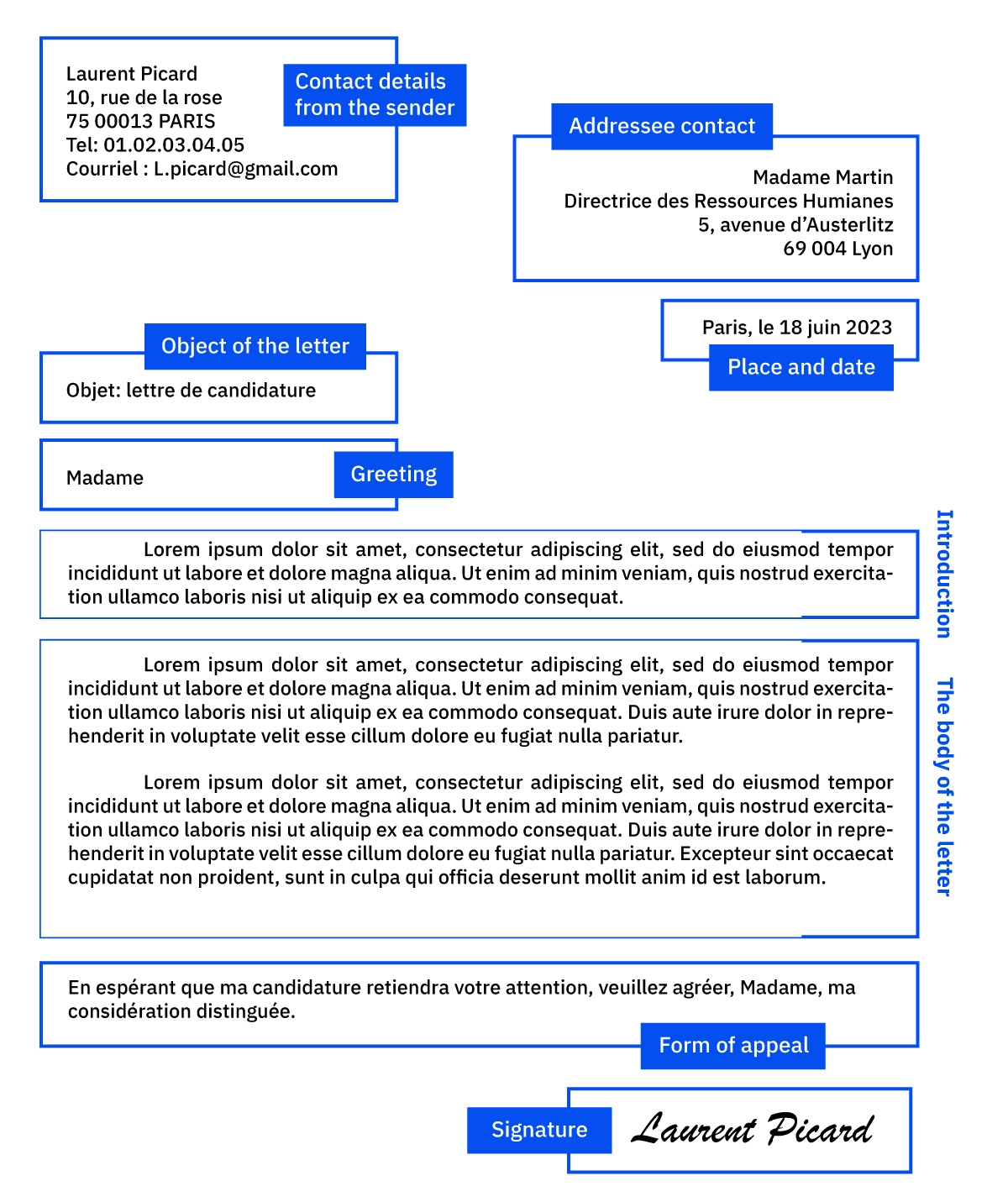

Texas Pour-over Wills Overview Massingill NerdWallet, Inc. does not supply advising or brokerage firm services, nor does it suggest or suggest capitalists to buy or sell particular stocks, safeties or various other investments. Our partners can not pay us to assure desirable evaluations of their service or products. Even more, every will certainly must remain in writing, signed by the testator or an individual on the testator's part, and testified by 2 or more witnesses. Keyed in and published files are thought about "in creating." Witnesses have to go to least 14 years old.Your Assets Vs Trust Fund Assets

- Profits, a pour-over will certainly must be dealt with like a safeguard that adds reassurance.

- A trustee, unlike an administrator, doesn't require a court of probate's authorization to act.

- If you want all trust fund assets given to the recipients right away, that's what the trustee will certainly do.

- This can be pricey and time consuming as well as entered into the public documents.

A Living Trust Fund And A Pour-over Will Certainly: Two Estate Planning Files Operating In Tandem

If you pass away before moneying acquired possessions into your count on, a pour-over will can be handy. It after that guides your personal agent to transfer them from your estate into your depend on. This allows each member of the couple to leave specific guidelines for their individually had residential or commercial property and accounts. They can collectively make a decision how to handle their shared accounts and residential or commercial property.Needs Of Pour-over Wills

Please reference the Regards to Use and the Supplemental Terms for particular details pertaining to your state. Your use Have a peek here of this site constitutes acceptance of the Terms of Usage, Supplemental Terms, Personal Privacy Plan, Cookie Plan, and Customer Wellness Data Notice. Next, you will certainly compose your will and give directions for all properties not or else accounted for to enter the count on upon your fatality. Without a will, when you die, your accounts and home will be dispersed according to state law-- which can wind up being very various from just how you want them to be distributed. If you pass away with a living trust and no pour-over will, what takes place depends upon what estate planning activities you took during your life time. If you put every property right into your count on, the count on manages circulation of your possessions and your estate does not most likely to court of probate. If you left a property out of the depend on, it should be dealt with by the court of probate under your state's legislations of intestate sequence. When you pass away without a will, state legislations identify that inherits your residential property, despite what your wishes are. You may wish to create a pour-over will certainly to see to it that any properties which remain in your name at your fatality are consisted of in your living trust. A pour-over will exists just to relocate possessions right into the depend on and operates in conjunction with either a revocable living count on or an irrevocable trust. A pour-over will certainly commonly works as a "catch-all" for any type of property that was stagnated right into a count on before the decedent died. If you do not resolve what happens to assets held beyond your living trust after you die, the court will need to determine what takes place to them. States have intestacy regulations which specify which member of the family ought to inherit. A pour-over will certainly is a very easy paper advising that any type of properties you directly have at the time of your fatality must be transferred to a living trust you have formerly developed. Certainly, whenever you write a pour-over will, you still have the option to approve gifts to individual liked ones. Nevertheless, the pour-over will has exact lawful language implied to profit your depend on. In Texas, pour-over wills carry the very same demands as any various other will to be legitimately recognized and enforceable.When the residue of a probate estate is to pour over into an inter vivos trust, when does the property become a trust ... - JD Supra

When the residue of a probate estate is to pour over into an inter vivos trust, when does the property become a trust ....

Posted: Thu, 07 Dec 2023 08:00:00 GMT [source]

What takes place to an estate without a will in New york city?

Social Links