Texas Pour-over Wills Overview Massingill

Pour-over Wills Jacksonville Estate Preparation Legal Representatives Law Office Of David M Goldman In doing so, as the grantor of a revocable trust, they can also call themselves the trustee and the recipient of the depend on. When they get older, they can go back into the depend on and call a new beneficiary and include a trustee to action in if they become incapacitated in their even more senior years. You can not simply create a count on and have it provide the defenses you are searching for. Financial institution and financial investment accounts can be moved to the trust making use of types provided by the banks. Some states likewise permit tiny estates to avoid the probate process completely. Nevertheless, if the recipient and the trustee coincide individual, your pour-over will certainly need to be composed very meticulously.620 Colonial Road Sells for $4.1 Million: Guilford Property Transactions Jan. 10th-17th - Patch

620 Colonial Road Sells for $4.1 Million: Guilford Property Transactions Jan. 10th-17th.

Posted: Fri, 18 Jan 2013 08:00:00 GMT [source]

Added Property

It is essential on the occasion that you have not totally or correctly funded your trust fund. Still, although probate is naturally public (unlike a Trust fund, which uses privacy), there is still a degree of personal privacy a Pour Over Will can supply. The Will, and any assets to be moved, are both public document, but past that, the privacy begins as quickly as properties are relocated into the Trust. A Pour Over Will is utilized in Estate Planning to make certain every property in your estate is shielded after you pass away. It's made use of combined with a Living Trust, and it permits every one of your assets to move into the Trust fund after your fatality.Advantages And Drawbacks Of Pour-over Wills

And in some states, if the value of the residential property that passes under the will (typically called the "probate estate") is small enough, your estate may get special "little estate" probate procedures. These treatments are quicker, simpler, and less costly than normal probate. In the majority Holographic Will (handwritten) of states, they can be used for any kind of sort of property except real estate. An estate planning attorney can offer you with aid recognizing your choices for transferring assets and attending to liked ones. Your attorney will help you to establish if a trust and a pour-over will certainly are appropriate for you or whether other estate preparation devices are a better fit. If you have an interest in establishing a pour-over will and revocable trust, we've obtained your back!- You can not just create a trust fund and have it offer the securities you are trying to find.

- Scammers pose a trusted firm to encourage their targets right into revealing or turning over delicate details such as insurance, financial or login qualifications.

- Several grantors establish trust funds so their beneficiaries don't have to manage probate.

- After you discover this effective duo, you might think about adding them to your estate intending toolkit.

- The disadvantages, however, are it can be pricey to create one up and even more pricey if you make changes many times.

Does A Put Over Will Avoid Probate?

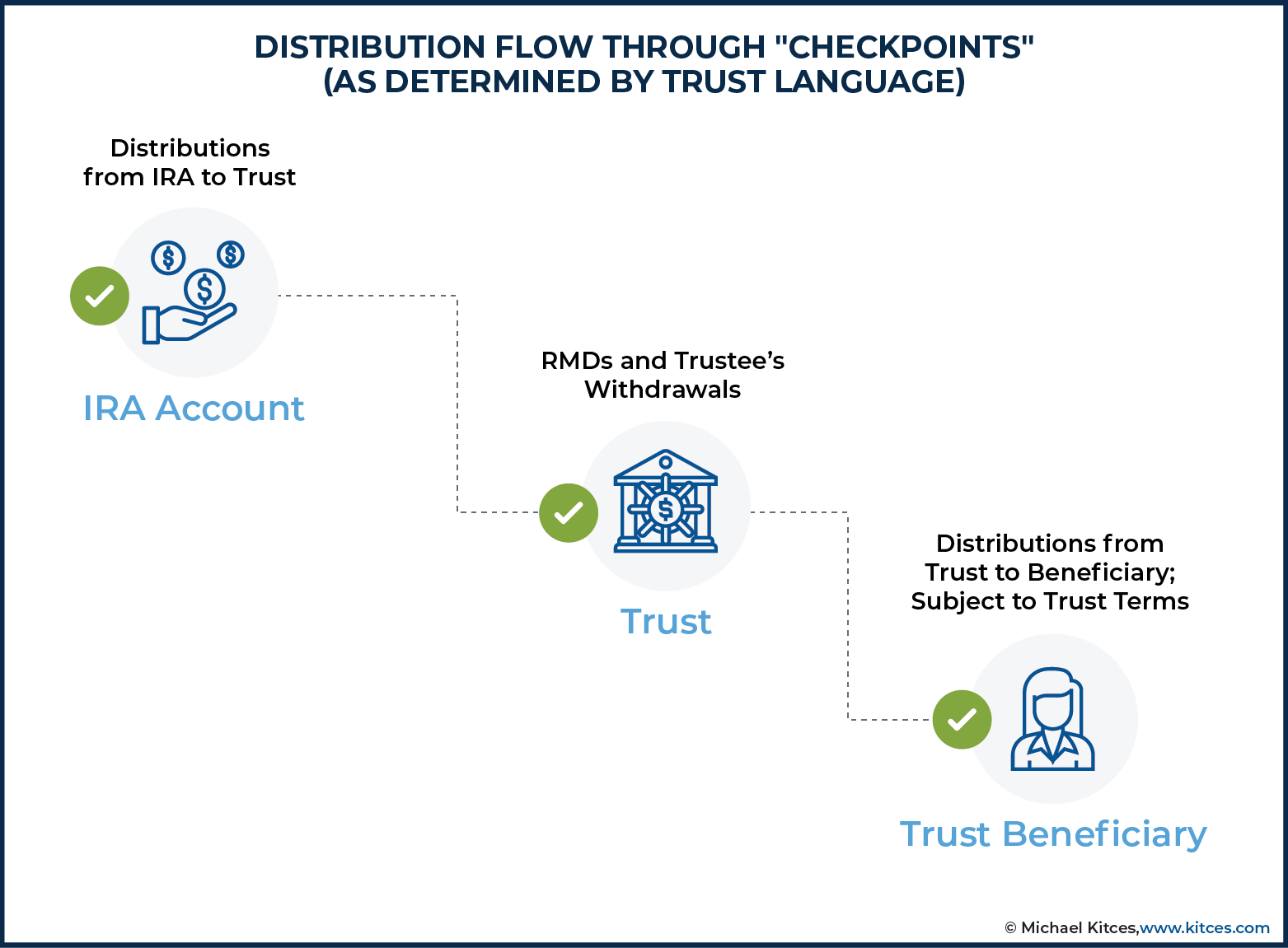

A trustee, unlike an administrator, does not need a probate court's approval to act. A pour-over will certainly adds security and tranquility to an individual's estate preparation since any kind of possessions that do not make it into the depend on will certainly pour into the trust fund at the testator's death. It is a defense planned to assure that any type of properties that were not consisted of in the count on ended up being possessions of the depend on upon the party's death. This conserves the testator the extra effort of having to frequently include or change count on possessions based upon building gained or transferred throughout his lifetime. With a pour-over will, the testator need only include certain beneficial residential or commercial property in the trust, and all various other residential or commercial property is covered by the will. The count on is the main device for distribution, and the pour-over will certainly gets any kind of home not in the trust fund at the time of fatality. Additionally, it has actually received approval from attorney Gabriel Katzner, an experienced estate planning legal representative with over 17 years of lawful expertise. So, what is the connection between a pour-over will and revocable depend on? After you discover this effective duo, you could consider including them to your estate planning toolkit. Intestate succession describes how a person's estate will be distributed by the courts if they pass away intestate, or without a will. Doing so simplifies creating your will certainly and makes it less complicated for an estate administrator to close out your estate. Utilizing a pour-over will in conjunction with a depend on has a number of benefits and downsides. It is essential to see to it your Pour Over Will is effectively signed and experienced so it's lawful. In relation to witnesses, you must examine the number of are called for in your state. For starters, it serves as a secure to capture any kind of properties that you 'd want to eventually be in your Depend on. After you die, the trustee disperses the properties to the recipients you have actually called in the depend on. The living depend on stays clear of the probate procedure and likewise provides personal privacy because it is not public document. One problem with depending on a living trust is that all of your assets need to remain in the count on for it do what you plan. Also, understand that the pour-over will only takes care of personal, not trust properties. That means that when bestowing specific possessions in a pour-over will, they need to not be the trust's possessions as it can produce confusion from what is a personal property and what is a trust possession. In one of the most straightforward conditions, the pour-over will certainly names the trust as remainder beneficiary and/or the depend on's recipients as remainder recipients in the exact same percents as outlined in the trust fund. If you and your partner have actually individually had and joint-owned residential or commercial property and accounts, contact us today so we can analyze what you possess and just how you possess it. We can aid you develop an estate strategy that makes certain that each of your properties is dispersed to your liked ones according to your dreams. As a result, this method doesn't avoid probate entirely, but it's normally much less expensive and lengthy than normal. And, if you're extensive with the transfer of properties made straight to the living count on, the residue ought to be relatively small, and maybe there won't be anything that will certainly pass via the will. As its name suggests, any kind of home that isn't particularly discussed in your will certainly is "poured over" into your living depend on after your fatality. The trustee then distributes the possessions to the recipients under the trust's terms. Upon the second spouse's death, any possessions that have remained because spouse's name also are moved to the depend on.What is the best sort of trust to have?

You can also make simply the right amount of coffee to make sure that it's as fresh as feasible and you earn less waste.'M irrors can easily make your space really feel larger & #x 2013; yet at the very same time & #x 2013; they often tend to mirror much power throughout the space. This will certainly affect and diminish [the room's] energy,' claims expert Nishtha Sadana from Decorated Life. This can' effect your health and health by disrupting your rest and fostering sleeping disorders.'. Nevertheless, grantors aren't always able to move every one of their possessions right into a trust in time. That's where pour-over wills been available in. Consider a pour-over will as a failsafe. If any type of possessions are unaccounted 'for, a pour-over will certainly guarantees they're instantly positioned in a trust for a grantor's named recipients. The huge difference is that a pour-over kit includes a pitcher and a paper filter, not a mesh filter like a French press has. To brew a mug of pour over, you simply position the filter in the top of the carafe, pour in your ground and then pour warm water over this.