August 14, 2024

Living Count On And Pour-over Will Certainly: Working In Tandem Understanding On Estate Preparation

Pour-over Wills In California The Law Practice Of Kavesh Minor & Otis, Inc Given that these possessions are separate from your individual possessions, anything possessed by the depend on will certainly prevent probate and be passed straight to your beneficiaries. Nonetheless, all properties utilized to fund the depend on requirement to be properly transferred in order to become trust properties. A pour-over will resembles any type of various other will except that it has one beneficiary, a living trust. This type of will certainly "pours" any kind of residential or commercial property possessed by the testator at death into a count on she or he established before diing. The assets will be subject to the circulation plan in the count on and will obtain the benefit of the count on's tax obligation decrease provisions.Do You Need To Speak With An Estate Preparation Attorney?

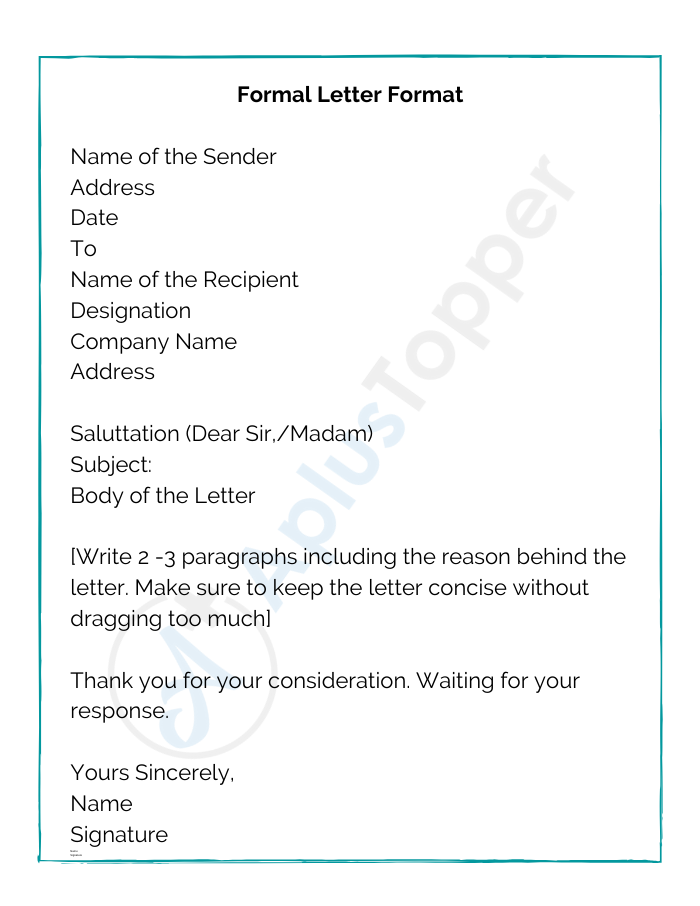

In putting together your estate strategy, one choice you might go after is establishing a revocable living trust fund. Throughout your life time, you can access the possessions in this kind of depend on and also make updates to it as required. A revocable living depend on additionally aids your enjoyed ones avoid the lengthy process of probate when you pass away. Need to you go this Geographical Considerations path, you may consider setting up a related file referred to as a pour-over will as well. A pour-over will is a last will and testament that works as a safety device to record any type of possessions that are not moved to or included in a living trust fund. While "funding" a living trust can be a simple process, sometimes properties don't always make it to the count on for a range of reasons.What Happens to Matthew Perry's Estate, Including His 'Friends' Residuals? Legal Experts Explain (Exclusive) - PEOPLE

What Happens to Matthew Perry's Estate, Including His 'Friends' Residuals? Legal Experts Explain (Exclusive).

Posted: Thu, 09 Nov 2023 08:00:00 GMT [source]

Getting Lawful Help From An Estate Preparation Attorney

Collaborating with an Austin estate planning attorney is critical to creating a valid and enforceable pour-over will. The The Golden State Probate Code has an one-of-a-kind arrangement that permits depend be produced after a pour-over will certainly holds. In several other states, the trust fund would certainly have to be created before the will, and the testator uses their will certainly to indicate their wish that remaining assets be moved into the existing trust upon their death.- This guide highlights the benefits of a living will certainly and why you ought to encourage loved ones to produce one.

- Ought to you go this route, you might think about setting up a related record referred to as a pour-over will also.

- And, if you're extensive with the transfer of assets made straight to the living trust, the deposit needs to be relatively tiny, and probably there will not be anything at all that will pass through the will.

- With a pour-over will, the testator requirement only consist of particular important home in the trust, and all various other residential or commercial property is covered by the will.

What is the distinction between a revocable and irreversible depend on?

Social Links