The Actual Impact Of Auto Accidents On Insurance Coverage Prices

How Much Does Auto Insurance Policy Go Up After An Accident?

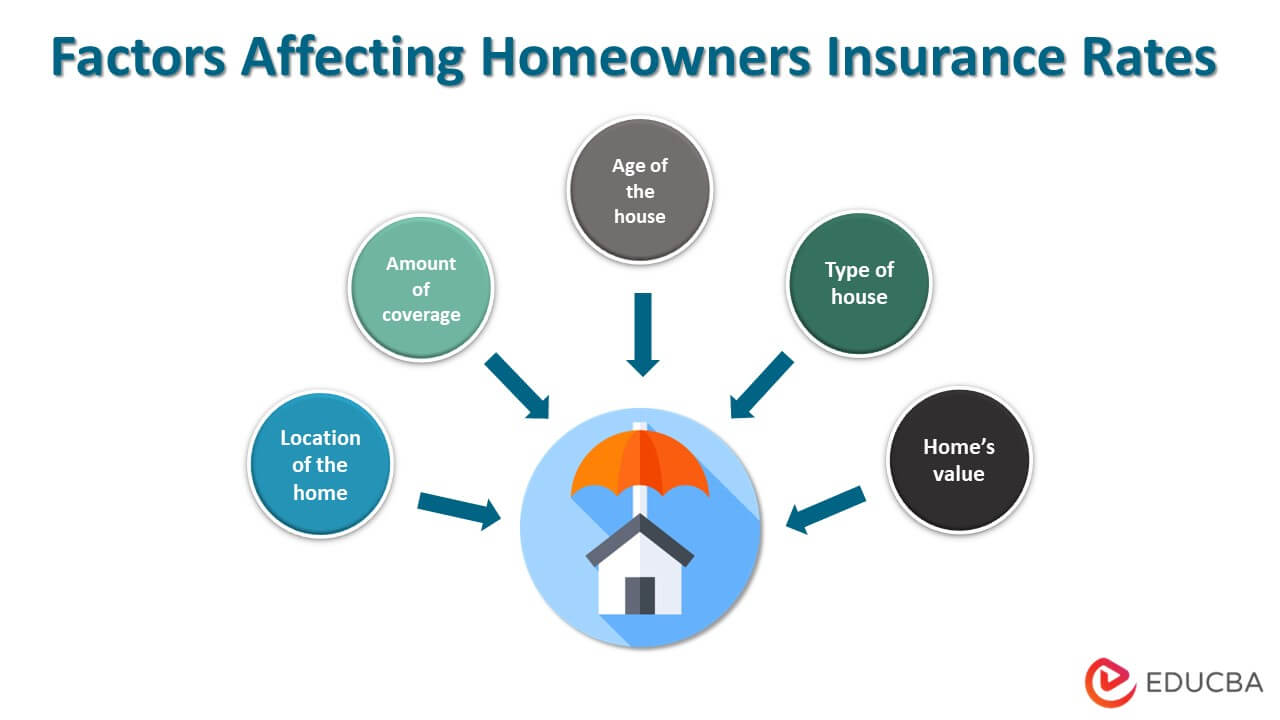

A rate rise shields insurance companies from shedding money. As a result, your company will certainly readjust your premium to mirror the higher danger taken on to guarantee you. Cars and truck insurance coverage can also maintain increasing because of aspects specific to you that have actually https://s3.us-east-1.amazonaws.com/car-loans-and-financing/car-comparison-tools/insurance-coverage/does-a-rap-sheet-influence-auto-insurance-coverage-prices.html altered from duration to period (like your area, age, asserts background, driving record, vehicle make and design, etc).

Reasons Your Car Insurance Costs Might Enhance-- Plus Our Pointers For Exactly How To Conserve

Every vehicle driver has various insurance policy requirements, especially concerning your spending plan. At David Pope Insurance policy, we comprehend your unique automobile insurance coverage needs, so we provide customized quotes to meet your needs and budget. We're flexible, dealing with vehicle drivers with different driving documents and mishap histories.

- If your insurance policy carrier offers this sort of layaway plan and you can afford to pay for your premium upfront, you might save money over time.

- As an example, adults tend to pay lower rates for vehicle insurance than teenagers.

- Women normally pay less for auto insurance than males, according to the III, because they're less likely to be associated with mishaps or major infractions and are more likely to use seatbelts.

- The even more points you accumulate on this record, the higher your insurance coverage rates will likely be.

- If you desire some inside understanding on vehicle insurance policy prices-- along with a couple of ideas on how to make certain you're not paying a cent more than you need to-- you're in the ideal place.

If your insurance policy premium is too expensive after a mishap, take into consideration exactly how these ideas can assist you cut prices. Adding another chauffeur or automobile to your plan can result in higher costs, as covering numerous automobiles and chauffeurs is extra expensive than covering just one car or individual. It might be feasible to take a sophisticated driving course with the objective of lowering your auto insurance premium.

To aid sustain our coverage work, and to proceed our ability to supply this content completely free to our visitors, we obtain repayment from the business that advertise on the Forbes Consultant website. You can be insured to drive a cars and truck on a policy in someone else's name. This can be done by being a named motorist on a person else's plan either completely or for a short duration. [newline] So, different tasks may be at higher risk, also if the work doesn't include driving. Fitzpatrick gained a master's degree in economics and international relationships from Johns Hopkins College and a bachelor's degree from Boston University. He is enthusiastic concerning utilizing his expertise of business economics and insurance to bring transparency around economic topics and assist others feel confident in their cash actions.

Even one speeding ticket or crash can raise your rates, according to the III. Insurance provider will commonly look at your driving record for the last 3 to 5 years but much more severe infractions, like a DUI or numerous speeding tickets, might be considered much longer. You may believe that your vehicle insurance costs drop when you hit 25 years of age.

How Long Does An Accident Stay On Your Driving Document?

Additionally, your insurer will inspect your credit report; a decrease since your last assessment can cause higher costs. Insurance companies reassess your risk level during policy renewal, looking for any modifications in your driving habits, credit history, and various other aspects. Rates commonly climb after car mishaps or website traffic offenses. Auto insurance companies may offer an introductory price cut when you get your first policy with them. Or maybe they started charging a fee to keep obtaining a paper costs. Check your declaration and call your insurance company if you have inquiries.