November 16, 2024

Which Catastrophes Are Covered By Home Insurance Coverage? Kin Insurance Policy

What Catastrophes Does Home Insurance Policy Cover? If you're in a position to cover even more expense if you sue, you can reduce month-to-month expenses. Raising your yearly insurance deductible from simply $500 to $1,000 can save as high as 25% on premiums, according to the Insurance coverage Info Institute. Company or specialist services, damage from flooding or below ground water, quakes or landslides, settling or deterioration, and animals, birds or insects. Do not skimp on insurance coverage just to save cash, though, or you might wind up paying a lot if catastrophe strikes. See our picks for the best property owners insurance coverage to begin shopping for a plan that's right for you.- Yet search with different home owners insurance provider to see if that holds true.

- We comply with stringent standards to make sure that our editorial material is not affected by marketers.

- This is due to the fact that insurance companies consider wider geographical and environmental factors when establishing rates.

- The golden state property owners might likewise find coverage via the California Quake Authority.

Which Disasters Are Not Covered By Homeowners Insurance?

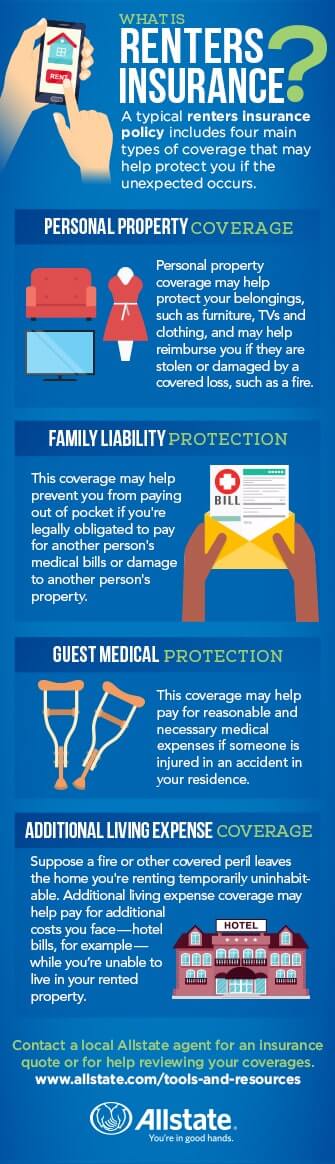

It is important to check out one's plan to comprehend specifically what is covered under the policy and to what degree you are covered as protection limits vary also. Requirement property owners insurance coverage covers a number of the typical natural catastrophes, except for flooding and quakes. The checklist of excluded natural catastrophes can differ state by state and by location generally. High-risk and/or coastal residential or commercial properties may need extra protections or standalone policies added to be secured from several of these perils. The most effective homeowners insurance coverage for all-natural catastrophes is one customized to cover your home's natural hazards threat.Does home insurance cover natural disasters? - Fox Business

Does home insurance cover natural disasters?.

Posted: Tue, 16 Feb 2021 08:00:00 GMT [source]

Does Home Insurance Cover Natural Catastrophes?

According to Ready.gov, floods are one of the most typical natural disaster in the United States. It might still be an excellent concept to have this sort of insurance coverage also if it isn't required. Home owner's insurance offers protection for a variety of perils, yet it's vital to comprehend what types of all-natural calamities are included in your plan. Hurricanes can trigger damage to your house, other structures and personal property with high winds, hail storm, flying particles and fallen trees. Most residence and personal effects coverage will certainly secure you economically from these kinds of damage. For example, if wind or hail storm damages your roofing system and it triggers rain to harm your home, you need to be covered unless your plan omits these hazards. Some locations prone to tornadoes may require separate deductibles for wind or hailstorm, called disaster deductibles. Flooding damages resulting from a hurricane is not covered under any type of conventional homeowners insurance coverage however would certainly be covered under a different flooding insurance policy.Twisters And Hurricanes

So a regular plan may pay for damage pertaining to a volcano-ignited fire. It may likewise pay for elimination of ash, which can gather in homes near an eruption. This insurance deductible makes it possible for insurer to supply coverage to even more people in hurricane-prone locations.Social Links