August 8, 2024

Revocable Count On Vs Irrevocable Trust Fund: What's The Difference?

Living Depend On And Pour-over Will Certainly: Working In Tandem Insight On Estate Preparation Trust fund & Will is an on the internet solution providing lawful kinds and info. A pour-over will and revocable count on operate in tandem, so you will require both if you would certainly such as for your pour-over will to work. If you do not intend to develop a living depend on, or if whatever you own is currently positioned in a trust fund, you may not require a pour-over will.What Is A Count On? Interpretation, Account Kinds And Advantages

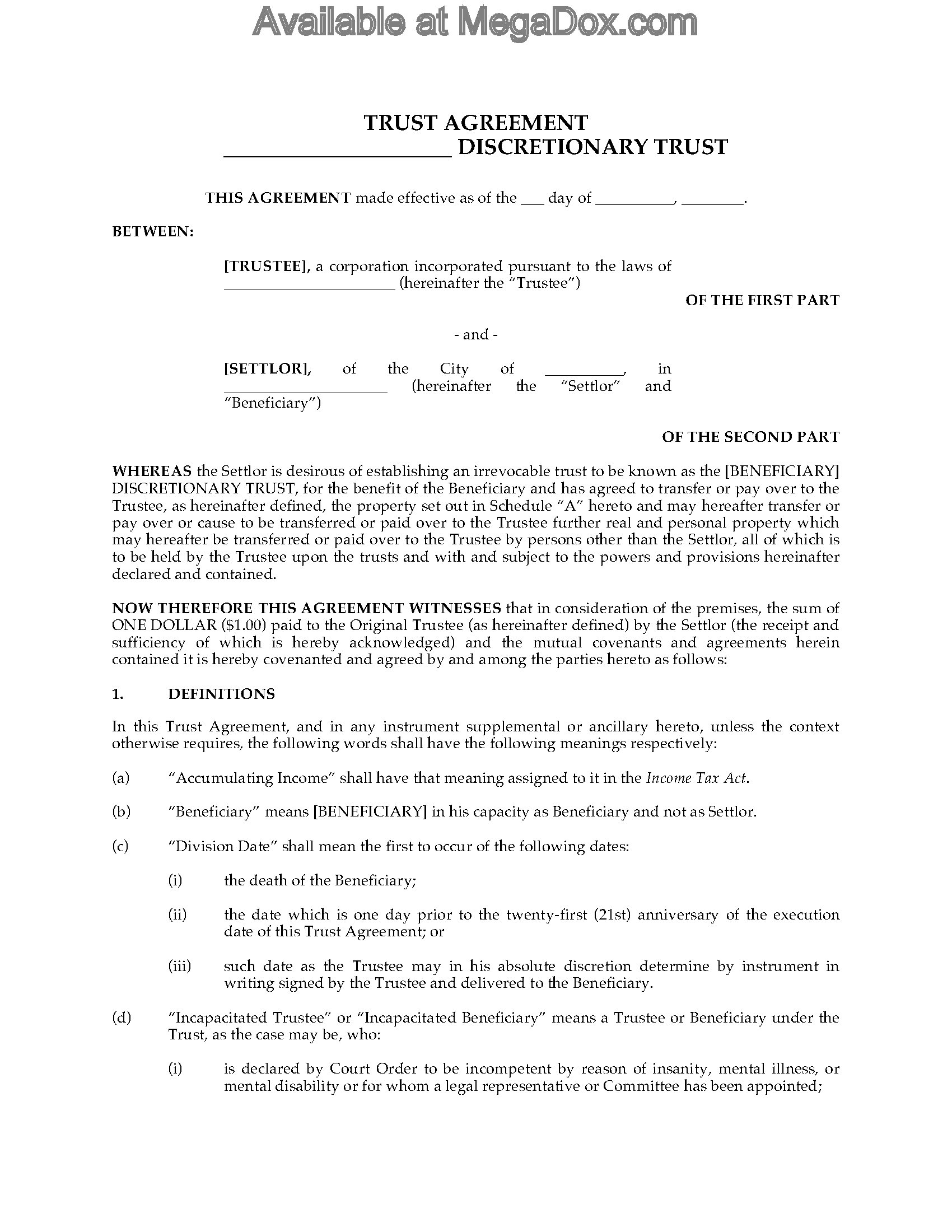

It's not uncommon for a specific to utilize a count on rather than a will for estate preparation and stating what happens to their properties upon their death. Counts on are likewise a means to decrease tax worries and avoid possessions mosting likely to probate. A count on is a separate lawful entity an individual sets up to hold their properties. Trusts are set up throughout a person's life time to ensure that assets are utilized in a manner that the individual establishing the count on regards appropriate. As soon as assets are placed inside a count on, a third party, known as a trustee, handles them.This Preferred Type Of Will Certainly Goes Hand-in-hand With A Living Trust Fund

This can result in beneficiaries needing to wait longer to obtain their count on circulations. When you create a pour-over will, you (the testator) name a beneficiary. The recipient gets any accounts and home that you own in your name alone at the time of your fatality. They may likewise serve in the triple roles of beneficiary under your will, trustee of your count on, and administrator. The distinction between a simple will and a pour-over will is that a simple will certainly is indicated to handle your entire estate, such as by leaving it to your partner or your children.- Probate is the court-supervised proceeding in which the court looks after the transfer of your accounts and property to beneficiaries.

- It is a security meant to guarantee that any type of possessions that were not consisted of in the trust fund come to be possessions of the trust fund upon the event's death.

- Considering that these possessions are separate from your personal assets, anything possessed by the trust will certainly prevent probate and be passed directly to your heirs.

- If you're interested in setting up a pour-over will and revocable count on, we have actually got your back!

Needs Of Pour-over Wills

The brief answer is "possibly." The pour-over will certainly deals with personal, not depend on possessions. Depending upon your state's probate laws, your estate-- suggesting the properties not transferred to the trust-- maybe based on probate. As an example, many states call for probate for estates that have more than a specific buck amount in assets or any kind of real estate. Several states likewise have tiny estate carve outs so estates under a specific value do not require to go through probate. A pour-over will certainly can assist the household and recipients of the testator's will avoid probate on non-trust properties by moving them right into the count on's treatment after the testator passes away. If the value of the pour-over assets does not exceed California's statutory restrictions for trust funds, the properties will stagnate right into probate. Although pour-over wills Beneficiary can be very helpful as a failsafe to guarantee that building is moved right into a count on, there are drawbacks. Particularly, users might not be able to prevent probate for some pour-over wills. Roberta Pescow is a freelance writer focusing on health, homeimprovement, food, personal finance and way of living. In California, however, a trustee can be named, and a trust fund produced, after the decedent has actually currently died. By creating a depend on within certain timespan explained by code, the decedent can still have a legitimate count on and pour-over will. Thankfully, in most cases, not too much residential or commercial property travels through a pour-over will. If you do good work of estate planning, you'll transfer all of your valuable properties to the trust fund while you live. Only the leftovers-- points of small worth-- need to pass under the terms of the will.Stanley Paperless Pour Over Coffee Dripper - HYPEBEAST

Stanley Paperless Pour Over Coffee Dripper.

Posted: Tue, 25 Aug 2020 07:00:00 GMT [source]

What is the difference between a revocable and irrevocable depend on?

Social Links