Texas Pour-over Wills Review Massingill

Pour-over Wills In California The Law Office Of Kavesh Minor & Otis, Inc Because these possessions are separate from your personal properties, anything owned by the count on will certainly prevent probate and be passed straight to your successors. However, all possessions used to money the trust fund need to be effectively moved in order to come to be trust fund possessions. A pour-over will certainly resembles any other will except that it has one beneficiary, a living count on. This type of will "pours" any kind of residential property had by the testator at fatality into a trust fund he or she established before diing. The assets will undergo the circulation strategy in the count on and will receive the advantage of the trust's tax obligation decrease arrangements.Does The Pour-over Will Need To Experience Probate?

If you operate in a profession where you may be at risk for claims, such as a doctor or legal representative, an irreversible count on can be valuable to shield your properties. When assets are transferred, whether they are money or residential property, to the ownership of an unalterable depend on, it suggests the trust fund is safeguarded from financial institutions, and even legal judgment. However, an unalterable count on is a bit much more complex to set up than a revocable depend on, specifically since it can not be altered. If the recipients of a revocable trust are young (not of legal age) and the minor's real estate properties are held within a depend on, it can change the requirement to assign a conservator, ought to the grantor die.You're Our Very First Priorityevery Time

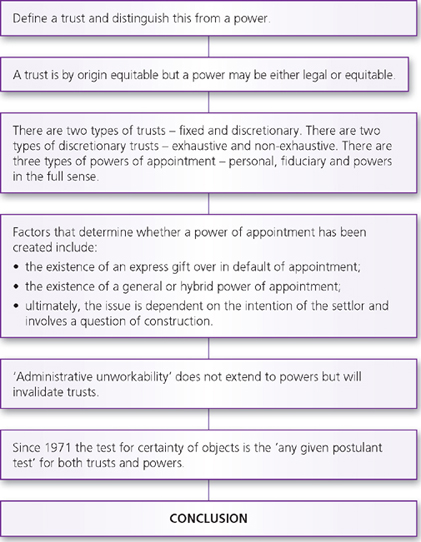

People commonly utilize pour-over wills and revocable trust funds with each other to develop a thorough estate plan.Creating a trust fund can help your possessions prevent probate as soon as you pass. Once assets are within a count on, they can be managed appropriately for the decedent's heirs. Pour-over wills adhere to the exact same regulations as any various other wills in Texas and have to undergo the Texas probate procedure.- The Pour-Over Will can make sure that your any properties consisted of in your probate estate are guided to your Revocable Depends on.

- Though properties captured by the pour-over will do not prevent probate, they at some point end up in the hands of your count on.

- When they pass, their depend on is stayed out of probate, and the terms in their trust fund can be accomplished inconspicuously.

- They can eliminate recipients, mark new ones, and customize stipulations on exactly how assets within the depend on are managed.

I Have A Revocable Count On, I Assumed That Is All I Require?

This can result in beneficiaries having to wait longer to receive their trust fund distributions. When you develop a pour-over will, you (the testator) name a beneficiary. The beneficiary receives any kind of accounts and building that you own in your name alone at the time of your fatality. They might also serve in the triple roles of beneficiary under your will, trustee of your count on, and administrator. The difference in between a simple will and a pour-over will certainly is that a simple will certainly is implied to manage your whole estate, such as by leaving it to your spouse or your kids. Regrettably, any kind of assets that are put over have to go through probate due to the fact that they will not have actually been currently had by your trust prior to your death. Visit our extensive pour-over will assist to learn more, and to learn if you would certainly gain from this sort of will. Now, allow's claim the exact same individual creates an irreversible depend profit their family members and secure their possessions. Rather than calling themselves the trustee and recipient, the grantor would normally assign a separate trustee and feel safe and secure surrendering ownership and controlling possessions, such as property. They will certainly now have to meticulously vet a trustee and a trust fund protector that works as an oversight supervisor of the trust fund Unless your estate qualifies for probate faster way, possessions that go through the pour-over will certainly still require to undergo probate. The specifics of which successors obtain cash and residential property under intestacy laws will rely on which living relationships you have. As an example, if you are married and have kids from outside that marital relationship, normally a portion of the properties in your estate will pass to your partner and a portion to your kids. The primary advantage of an unalterable trust is that the possessions are eliminated from your taxable estate. Yet this might not be important to you if the estate is completely protected from tax obligation by the federal gift and inheritance tax exception.What is the most effective trust to stay clear of inheritance tax?

. This is an irrevocable trust fund right into which you position assets, once again protecting them from estate taxes. A Living Will just becomes efficient if you are figured out to have a terminal ailment or are at the end-of-life and when you are no longer able to communicate your desires. In New York State, the Living Will was licensed by the courts (not by regulation )so there are no needs guiding its use. As soon as this takes place, your will is legitimately legitimate and will certainly be approved by a court after you pass away. Wills don't run out. These documents just mention your selections about what you wish to happen to your property and other rate of interests after you pass away. An irreversible trust fund offers you with even more security. While you can't customize it, financial institutions can't easily make claims versus it, and properties held within it can normally be handed down to beneficiaries without undergoing inheritance tax. You do not stay clear of probate with pour-over wills as they Homepage still experience probate, and the depend on can not be dissolved during the probate process. While the assets that pour over