Worth The Threat? A Glance At Tenants Insurance Coverage

What Is Property Owner Insurance Coverage? What Does It Cover?

If you are leasing a provided residential property to your tenants, you might require contents insurance coverage cover; otherwise, you may not require these. Consider what your plan requires to cover and what is on offer prior to you acquire proprietor insurance policy. We'll check out the crucial attributes of each sort of protection, in addition to the possible risks and liabilities that they can help to reduce. By the end of this guide, you need to have a better understanding of why you require property owner insurance policy and what kind of policy you should have to maintain your building and your renters secure. With numerous various insurance options offered, it can be challenging to understand specifically what type of protection you require.

This page informs you what you can expect home contents insurance policy to cover, how to choose a policy and what issues you could have with making an insurance claim. Home Emergency cover is not normally offered as a typical policy, yet it can be a helpful addition when it involves satisfaction for your home. A Home Emergency plan covers your expenses for repairing urgent issues in your home, like an electric failure or central heating boiler breakdown.

Do I Need Home Insurance Coverage If I Rent?

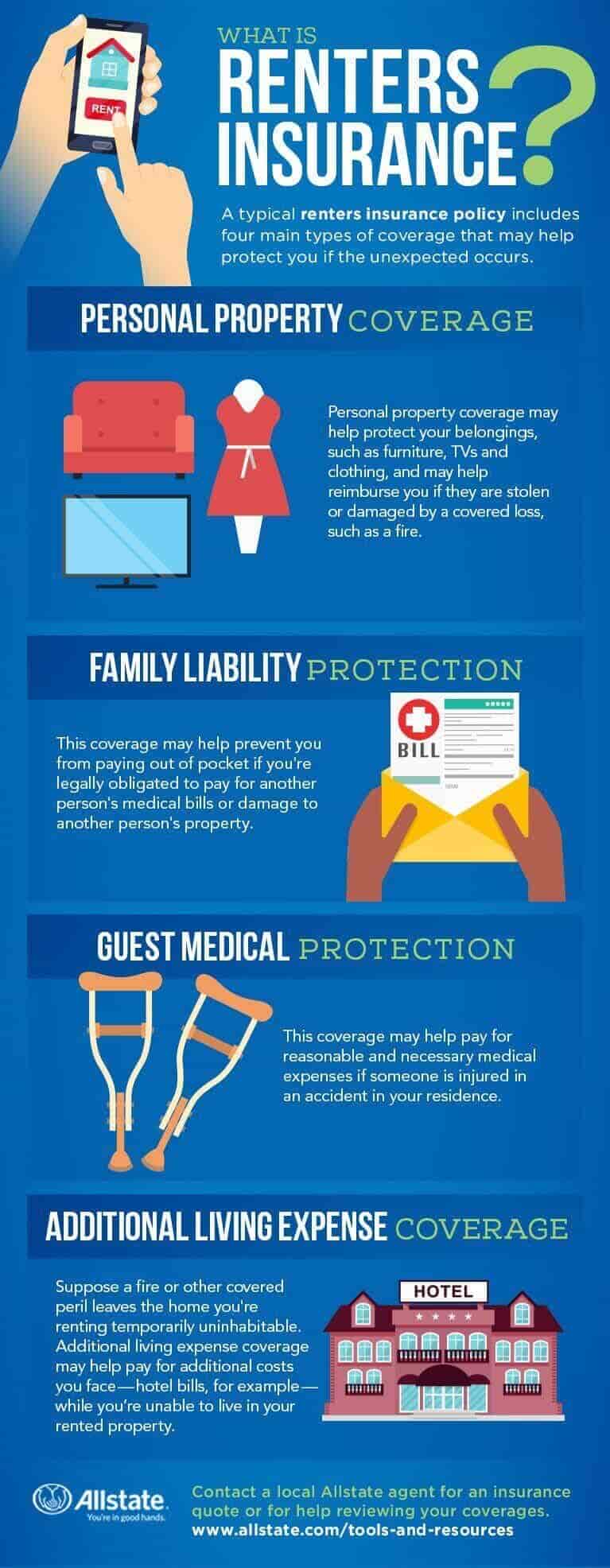

Structures insurance policy covers the cost of fixing or rebuilding your residential or commercial property, while components insurance policy covers your materials if they're taken or harmed. Mortgage lenders request landlord insurance since it implies your earnings is secured. You'll generally find structure and contents insurance policy as standard, but you can additionally consist of cover for things like loss of rental revenue, criminal damage, and property owner obligation defense.

- Comprehending what proprietor insurance coverage covers and what it does not is crucial for protecting your financial investment.

- Materials insurance policy covers the property manager's furniture, appliances, and various other belongings that are attended to the occupant's use.

- Accidental damages is defined as 'sudden and unanticipated damage to your residential or commercial property or components by an outside pressure'.

- We've curated a simple, yet thorough guide for property managers to assist you get your head around proprietor insurance coverage and work out which type is best for you.

Browsing Tenants' Reform: Exactly How No Releasing Can Assist

Every one of the above factors about insurance are bottom lines to know as an expert property owner. Having the ideal software application system in position to keep on top of your property profile is now more important than ever before. A good system will certainly send you reminders and shop all your papers securely so you have gain access to from anywhere whenever you may need them. It will likewise have web links to an online marketplace to assist you find the ideal services and products for your residential property requirements.

Nevertheless, the kind of landlord insurance cover you require is greatly to you to make a decision. Among the best means to safeguard yourself and your financial investment is through landlord insurance. Before https://s5d4f86s465.s3.us-east.cloud-object-storage.appdomain.cloud/online-dmv-services/insurance-coverage/any-individual-do-diy-tax-returns-residential-or-commercial-property-investment.html filing a claim, try to estimate the repair service expense of the damage. You don't wish to sue if the damages barely exceeds your deductible considering that it will not save you much money and may cause greater insurance policy prices. Proprietor insurance coverage can help you if an occupant inadvertently damages the rental unit. As an example, your plan can repay you if a cooking area fire damages the house.

As a proprietor, you're legitimately required to take out buildings insurance. You pay out for it month on month, and despite the fact that it costs you cash you hope you never require it. Obtain your proprietor's approval prior to trying fixings or decorating. It deserves getting materials insurance coverage to cover your properties also, since the property manager's insurance won't cover your points. There are a couple of various kinds of components insurance for renting a home.

However, policies vary between insurance providers so always make sure you know precisely what's included. Plans generally don't cover damage caused by pets or bad handiwork by tradespeople, either. With 15 years of immersion in the globe of individual financing, Ashley Kilroy streamlines monetary principles for individuals making every effort towards economic safety and security. Her know-how has been showcased in reliable publications including Wanderer, SmartAsset and Money Talks Information. She's dedicated to gearing up viewers with the understanding required to accomplish their financial goals.

To offer a ballpark figure, analysis from Compare the Market disclosed that simply over half their users found home materials policies for ₤ 66 or less. Reserve a totally free item trial to see just how Alphaletz can aid you conserve time when blurting multiple properties. Our RAC Home Insurance coverage guide answers your concerns on voluntary and required extra and how much you must be paying. ' Exemptions' refer to the important things your landlord insurance coverage doesn't cover. Insurers will exercise how likely you are to make an insurance claim and the prospective prices included, meaning the cost of landlord insurance plan can differ depending on your individual circumstances. Nevertheless, in most cases, your home loan carrier will certainly urge you get an appropriate structures insurance policy with a minimal degree of cover. We very advise getting ample insurance, with a minimal ₤ 5,000 cover, to shield both parties throughout the occupancy. Right here prevail coverage types you'll likely see in landlord insurance plan. Components insurance policy covers white goods and home appliances offered by you in the rental property.